Are there better ways to accelerate shared efforts to engage businesses, workers, labor organizations, communities, investors, supply chains, and others to yield more good companies and good jobs?

I was angling for answers through my first-ever engagement with the annual SOCAP conference. Social Capital Markets convenes investors, entrepreneurs, and social impact leaders and is known particularly for their annual conference. My experience rubbing elbows with more than 3,000 like-minded peers invested in improving both job quality and business outcomes highlighted three important takeaways for practitioners in this field.

1. Good jobs are good investments

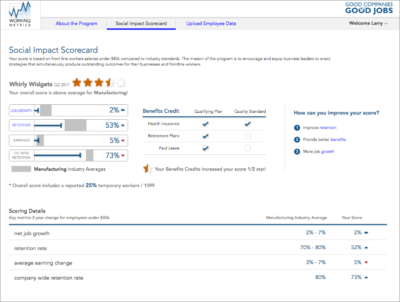

At the conference, I joined a panel discussion – Good Jobs ARE Good Investments – organized by Investor Circles’ Renata Hron Gomez with presentations also from Ed Brisco, Founder and Co-Director of Impact Charitable, and Mary Jo Cook, President and CEO of Pacific Community Ventures. With more than 60 audience members, this panel presented a great opportunity for me to describe the pathway of the Good Companies/Good Jobs Initiative’s work from our original research on exemplary firms to our more recent efforts exploring ways to foment ready, willing, and able businesses to become more like these job quality pioneers. It also allowed me to present the Good Companies/Good Jobs Software System. Developed with our for-profit partner Working Metrics, this cloud-based approach minimizes data reporting burdens on firms while also facilitating analytics, benchmarking, and scoring on key outcomes for frontline workers. Firms are benchmarked on turnover/retention, growth in workers’ earnings, and net job creation/losses. We also assess access to and quality of benefits such as health insurance, paid leave, and retirement. Recognizing this tool’s potential to simplify how businesses assess the outcomes of job quality innovations for their frontline workers, audience members demonstrated extensive interest following the panel. SOCAP staff eventually had to remove from the meeting room to set up the next panel. Good jobs are a good investment, and this tool can make it easier for practitioners to demonstrate this to business leaders.

At the conference, I joined a panel discussion – Good Jobs ARE Good Investments – organized by Investor Circles’ Renata Hron Gomez with presentations also from Ed Brisco, Founder and Co-Director of Impact Charitable, and Mary Jo Cook, President and CEO of Pacific Community Ventures. With more than 60 audience members, this panel presented a great opportunity for me to describe the pathway of the Good Companies/Good Jobs Initiative’s work from our original research on exemplary firms to our more recent efforts exploring ways to foment ready, willing, and able businesses to become more like these job quality pioneers. It also allowed me to present the Good Companies/Good Jobs Software System. Developed with our for-profit partner Working Metrics, this cloud-based approach minimizes data reporting burdens on firms while also facilitating analytics, benchmarking, and scoring on key outcomes for frontline workers. Firms are benchmarked on turnover/retention, growth in workers’ earnings, and net job creation/losses. We also assess access to and quality of benefits such as health insurance, paid leave, and retirement. Recognizing this tool’s potential to simplify how businesses assess the outcomes of job quality innovations for their frontline workers, audience members demonstrated extensive interest following the panel. SOCAP staff eventually had to remove from the meeting room to set up the next panel. Good jobs are a good investment, and this tool can make it easier for practitioners to demonstrate this to business leaders.

2. Norms can be changed

Unearthing, examining, and effectively challenging industry norms about employment and job quality has been the core of my work for more than a decade, and is part of the continued mission I have brought to the Good Companies/Good Jobs Initiative. A session by Context Partners offered some ideas around progressing from a set of ideas or principles to a movement. They define a “movement” as “a group of diverse individuals and organizations seeking to change social norms.” A simplified description of Context Partner’s approach – used by major brands, foundations, and nonprofits – includes three main steps. First, form a shared purpose that key stakeholders can all embrace and can see how they can help accelerate. Second, understand and ignite each stakeholders’ key roles consistent with their motives and values. For example, while some investors will accept somewhat lower returns or higher risk as necessary to achieve social impact, many more will act differently if return/risk can be managed with desired social outcomes. And third, align rewards with the stakeholders’ needs and wants. Interestingly, Context Partners emphasizes that, often, material rewards are less important than experiential or reputational value delivered. You can learn more about the Context Partners approach at contextpartners.com/approach.

3. Impact investing can be mainstream practice

SOCAP launched The Good Capital Project (GCP) earlier this year as an integral step in evolving impact investment from an emerging industry into mainstream practice. Through a new design thinking process, GCP is convening all constituents to drive greater collaboration and accelerate capital flows into purpose-driven investments. The year-round effort seeks to leverage expertise from the financial, design, academic, non-profit, governmental, and impact communities to contribute best practices from existing initiatives to create a more purpose-driven impact economy. Developing new tools, resources, and frameworks to leverage the financial services community is among its key goals. This is one effort worth the effort to monitor and to join. Find more at goodcapitalproject.com/about.

The annual SOCAP conference delivers an array of plenary sessions, and the conference app does a great job of facilitating outreach and scheduling one-on-one side meetings for participants. SOCAP17, a meeting about impact, is indeed an annual field “must do” and influencer.

This piece originally appeared on LinkedIn.

Mark G. Popovich is the director of the Economic Opportunities Program’s Good Companies/Good Jobs Initiative.

Photo credits: SpringFour, Dennis Price