The Program on Philanthropy and Social Innovation (PSI) mourns the passing of the great civil rights advocate John Lewis.

As part of his tireless work to help those in need, Lewis was an advocate for taxpayers and tax fairness. When PSI sought to make nonprofit tax forms more accessible to the public, we found an early and consistent champion in John Lewis. He helped pass an “open” Form 990 information and transparency law, which he described as “sound and good policy.” The provision became law in 2019 with the passage of the bipartisan Taxpayer First Act, which, among other things, includes programs to assist low-income taxpayers prepare their returns.

John Lewis touched our lives in so many ways. He will be sorely missed.

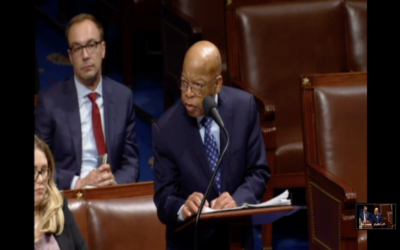

Rep. John Lewis (D-GA) Discussing Bill on House floor

House Passes Nonprofit Information & Transparency Bill

Originally published on April 17, 2019

Great News! The U.S. House of Representatives just passed a bill that makes it easier to track important trends in the nonprofit sector!

H.R. 1957, Taxpayer First Act of 2019 was passed in the full House through a procedure used for non-controversial measures.

The bipartisan bill, which works to improve the Internal Revenue Service, includes a provision requiring mandatory electronic filing of the Form 990 and the release of the tax forms in an open, machine-readable format. Rep. John Lewis (D-GA) and Rep. Mike Kelly (R-PA) took central roles on the measure.

The Aspen Institute’s Nonprofit Data Project of the Program on Philanthropy and Social Innovation has been leading efforts to improve the accessibility and quality of information on our nation’s nonprofit sector. Our partners include nonprofit research organizations, such as Candid, Urban Institute, Indiana University and Johns Hopkins University.

By expanding electronic filing of nonprofit tax forms (Forms 990), and providing more complete, searchable information on nonprofit organizations, this new policy will benefit the nonprofit sector and the public by making it easier to identify gaps in the field, gauge the financial and programmatic health of the nonprofit sector, make informed charitable giving decisions, and reduce charitable fraud.

If passed, the open Form 990 data law would go into effect the tax year after its enactment. A delay in implementation may be granted for small organizations, or organizations for which Treasury determines that the law would cause an undue burden, as well as organizations filing the Form 990-T. Delays may not apply for more than two years after the law is enacted.

Action now goes to the Senate, where a bipartisan companion bill has been introduced by Senators Grassley and Wyden. Stay tuned!

For more information, contact Cinthia Schuman Ottinger at cschuman@aspeninst.org.