2020 will go down in history as the year we were hit by the Covid-19 pandemic. But if there were to be an addendum, it would almost certainly reference climate. As the global economy came to grips with the economic and human implications of the crisis last year, there emerged a growing realization that in the brief moment of clear skies and an unprecedented 7% dip in global carbon emissions (albeit at a grave economic and human cost), lay a window of opportunity. This discovery ensured that even at the height of the pandemic and in contrast to expectations, we saw a persistent trend of climate-focused headlines, record issuance of sustainable debt, inflows into clean energy funds, and net-zero pledges from governments and corporates alike. As we enter into the new year with a climate-focused US presidential administration and heightened investor focus, we have a moment that is ripe for markets and policy to converge. The question is: will we seize it?

Climate transition has emerged as a secular theme—a driver of risk but simultaneously declared the greatest investment opportunity of our time. Understanding the implications and direction of travel of this transition will help us unpack the course of the global economy for decades. And underlying this shift is the increasingly virtuous, self-reinforcing way in which three key entities interact with each other—countries, corporates, and consumers.

With the US reinvigorating its climate leadership under President Biden, the transformative vision of his climate plan has the opportunity to boost economic growth at a time of severe unemployment and slowdown. Indeed, even outside the US, the economic downturn and resultant low interest rates saw many governments increase their fiscal spending toward infrastructure and clean energy. Although so-called ‘green stimulus’ is less than 1% of the almost $12 trillion announced in global Covid-19 related stimulus packages, it has the potential to create outsized impact per dollar. For example, the EU Green Deal announced last year, has the potential to drive almost €10 trillion in cumulative investments by 2050 including in hard-to-abate sectors that will be crucial to global decarbonization[1], while the December stimulus plan in the US puts the country in compliance with the Montreal Protocol for phasedown of HFCs. Along with the focus on deep decarbonization of specific sectors, emphasis also needs to be paid toward enabling a just transition for some fossil-based industries that are experiencing a secular decline as we emerge out of this crisis.

Even as governments pledge to increase spending toward climate initiatives, the clearest ramification of climate policy will be for cross-border trade. With the EU putting guardrails around the definition of ‘green’ through its taxonomy regulation and the UK, New Zealand, and Hong Kong mandating climate disclosure, the topic of carbon leakage will be a crucial point not just within the walls of the WTO but for the private sector as well.

Despite the challenges of embedding more green elements within stimulus plans and uncertainty on carbon-border adjustments, the political architecture created by the Paris Agreement has played out remarkably well even if it may not be the end goal. As both market and popular sentiment have shifted, channeling those shifts into political will on climate action has been a win for the treaty. Notably, China’s 2060 net-zero pledge was a boost followed closely by Japan and South Korea as well as interim 2030 targets from the EU (reduction of 55%) and the UK (reduction of 68%). The result is that with a potential similar commitment in the US, countries accounting for more than two-thirds of global emissions will be subject to net-zero targets by mid-century. And albeit ‘voluntary,’ these commitments are increasingly trickling down into mandated legislation at the state and local level, making climate transition a tangible business and economic force.

With the backdrop of government action, private sector focus on decarbonization is changing market and industry dynamics as corporates and asset managers emerge to be front-players on climate. Several notable developments illustrate this—the number of listed companies with a net-zero pledge has tripled over the past year alone from 500 in late 2019 and sustainable debt surpassed the $1 trillion milestone last year with green bonds accounting for 77% of that market. Not only are companies like Apple and Walmart including their supply chains in the scope of their climate plans, but they are also creating their own versions of climate clubs as in the case of Amazon’s Climate Pledge, where the forces of competition in effect, are becoming drivers of innovation. Corporates are feeling encouraged by favorable economics and policy signals—General Motor’s plan to shift to electric vehicles, for example, complements Biden’s EV procurement strategy.

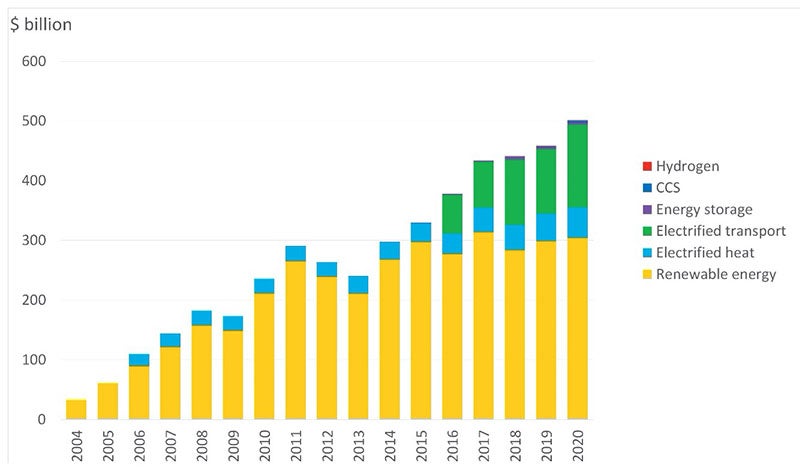

The result of this private sector focus on decarbonization has been a gradual shift away from the one-dimensional understanding of decarbonization as clean energy to the creation of an entire ‘ecosystem’ of parallel and complementary technologies illustrated by the ‘Energy Transition Investment’, a new measure of decarbonization activity created by Bloomberg New Energy Finance. The $501 billion deployed toward energy transition investment in 2020 highlights the synergies that exist in decarbonization costs curves across renewables, hydrogen, transport, and CCUS. And interestingly, consumer investment is becoming an increasingly larger share of this capital.

Source: BNEF

Perhaps this shouldn’t be a surprise. Consumer sentiment and engagement on sustainability have only deepened during the Covid-19 crisis. This is being felt particularly through lifestyle preferences related to travel and retail which are in turn causing corporates to rethink what, why, where, and how they produce their goods and services.

Even as momentum grows, the speed at which countries, corporates, and consumers embrace the shift toward low-carbon alternatives will be driven by the evolution of a few key mechanisms this year:

Mainstreaming financial innovation

As important as technological innovation is to bring down the decarbonization cost curve (around half of the global emission reductions to achieve net-zero must come from technologies that have not yet reached commercial markets[2]), financial innovation is an increasingly powerful incentive and accelerant, both for corporates and investors.

Although sustainable debt is less than 3% of total debt, innovative financing mechanisms can help scale the market. Indeed, the case for green or climate bonds is being bolstered by the increasing evidence of a ‘greenium’ for issuers coming to market with these instruments. The expansion of this market into performance-linkage where the cost of capital is tied to meeting a corporate sustainability target (kickstarted by the Italian energy company Enel) is an area of growth for climate finance, particularly in light of the capital needed to achieve the flurry of net-zero pledges. Sovereigns have been slower to adopt this model as compared to the private sector despite there being massive capital needs for national climate goals (in fact it is a surprise to many that Fannie Mae is the world’s largest issuer of green bonds). At the same time, there is a growing realization of the importance of developing roadmaps for sectors such as mining, steel and cement that will enable the decarbonization of the real economy and can be supported through a market for ‘transition finance’ across various shades of green. Unsurprisingly, the need is staggering—by one estimate there is a requirement of $100-120 trillion in investments over the next three decades to transition to a low-carbon economy.[3]

Making nature an asset class

Carbon markets are maturing with clearer price signals (especially in the EU which has seen years of oversupply) and an industry-led effort that is trying to establish a global standard for the credibility of carbon offsets[4]. China launched an ETS which will cover 5% of global emissions this year—making it the largest carbon market in the world. Alongside these developments, emissions monitoring technologies are maturing and investments into carbon capture and storage are rising. However, scale remains a challenge. That may change this year as more corporates lean into nature-based solutions to raise demand, currently being met by only a handful of small, voluntary markets. Negotiations on certain aspects of Article 6 of the Paris Agreement will also have ramifications as the private sector looks for more clarity on the contours of carbon markets globally. Similarly, negotiations at another COP—COP15—will heighten the already rising focus on biodiversity risks. With the backdrop of devastating wildfires and hurricanes last year, efforts to capture biodiversity impact not least through the TCFD-styled Task Force for Nature-related Disclosures and the recently released Dasgupta Review will be top of mind for investors.

Defining net-zero

Perhaps the most frequently used word in climate circles last year was net-zero. While there is broad agreement on its equivalence with zero carbon emissions around 2050, expectations differ on both the short and medium-term milestones and the mechanisms used to get there. Despite the still-evolving understanding of the concept, 30 of the world’s largest asset owners with a combined $5 trillion and 30 of the largest asset managers overseeing $9 trillion committed to meeting portfolio decarbonization targets consistent with the Paris Agreement. Getting to net-zero is important but it needs a lot of work in the context of data and portfolios with several analyses showing that despite portfolio reallocation, real-economy emissions reductions remain elusive. This has emerged as a particularly tricky disposition for businesses who, on the one hand, are facing stakeholder pressures on ‘Paris-alignment’ and on the other, are grappling with ensuring that their capital decisions have actual impact. Hard-to-abate sectors in need of critical capital to enable their transition to low-carbon alternatives will be particularly at risk of being excluded if we don’t take a more fundamental approach to drive the transition through engagement.

A systemic approach is being built, buoyed by the secular tailwinds of favorable policy, economics, and consumer preferences. Renewables are poised to outstrip oil and gas spending for the first time in history this year—they already overtook fossil fuels as the largest source of power generation in the EU for the first time last year—decarbonization cost curves are coming down and the goals of the Paris Agreement seem to be in sight again, not least with the potential to create 15-20 million jobs globally by 2030. However, closing the investment gap for climate finance will need capital deployment at a speed and scale that doesn’t exist today, in addition to the backdrop of a global economy hamstrung by Covid-19 recovery. How quickly we can reduce this gap between policy ambition and actual dollars deployed will determine the course of the transition to a low carbon economy.

But if anything, the lessons from 2020 will be the crossroads of 2021. Let us use them wisely.

The views expressed in this article do not necessarily reflect those of any organizations that the author is affiliated with.

[1] Goldman Sachs Global Investment Research

[2] International Energy Agency, “Energy Technology Perspectives 2020,” Paris: IEA, 2020

[3] GFMA Climate Finance Market Structure Report

[4] IIF Voluntary Taskforce on Scaling Voluntary Carbon Markets