On Thursday, March 16, the Aspen Institute will convene its 2017 Summit on Inequality and Opportunity. A collaboration between the Institute’s public programs and its policy programs, the Summit is a one-day gathering dedicated to dialogue about the widening opportunity gap in the United States. More than 400 policymakers, thought leaders, social entrepreneurs, philanthropists, and practitioners from all over the country will gather for a day of ideas, exchange, and inspiration. Among them will be Mission Asset Fund CEO José A Quiñonez, who agreed to share his commentary on inequality and immigration in America.

Here’s what we know about wealth inequality in America today: It’s real, it’s huge, and it’s growing. Barring substantial policy change, it would take 228 years for black households to catch up to white households’ wealth, and 84 years for Latinxs to do the same. This matters because wealth is a safety net. Without that cushion, too many families live just one job loss, illness, or divorce away from financial ruin.

Here’s another thing we know: Contrary to popular opinion, wealth inequality between racial groups did not come about because one group of people didn’t work hard enough, or save enough, or make savvy enough investment decisions than the other.

How did it come about, then? The short answer: history. Centuries of slavery and the bitter decades of legal segregation laid the groundwork. Discriminatory laws and policies against people of color made things worse. The G.I. Bill of 1944, for example, helped white families buy homes, attend college, and accumulate wealth. People of color were largely excluded from these asset-building opportunities.

Today’s racial wealth divide is the financial legacy of our country’s long history of institutionalized racism.

The factor of time is, in some ways, foundational to these findings. Sociologists, economists, and journalists alike all underscore how the racial wealth gap was created and exacerbated over time. But when it comes to the question of new Americans—the millions of us who have joined this nation in recent decades—time often gets glossed over in racial wealth gap conversations.

Reports generally illustrate the racial wealth gap by, understandably, placing the average wealth of different racial groups side by side and observing the gaping chasm that divides them. For example, in 2012, the average white household owned $13 in wealth for every dollar owned by black households, and $10 in wealth for every dollar owned by Latinx households. This story matters. There is no denying that. But what might we learn from investigating wealth inequality with more attention to immigration?

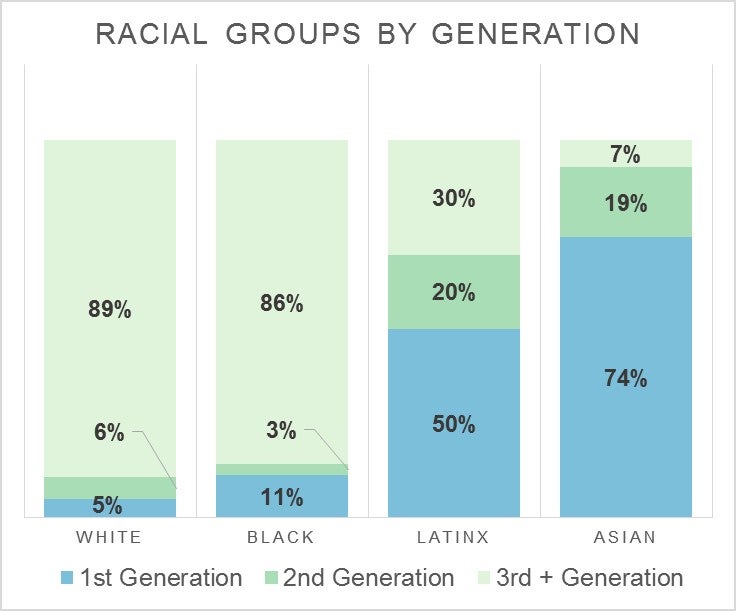

A report by the Pew Research Center divided the population of adults in 2012 into three cohorts: first-generation (foreign-born), second-generation (US-born with at least one immigrant parent), and third-and-higher generation (two US-born parents).

Here’s how the numbers look when broken down by race:

Clearly these racial groups have very different American stories.

The vast majority of Latinxs and Asians are new Americans. Seventy percent of Latinx adults and 93 percent of Asian adults are either first- or second-generation Americans. In contrast, a mere 11 percent of white and 14 percent of black adults are in the same generational cohorts. By comparison, the latter groups have been in the United States for much longer. And given their relatively comparable tenure in the US, it makes sense to place their data side by side. But comparing the wealth of Latinxs—half of whom are first-generation Americans—to that of white families, 89 percent of whom have been in the US for many generations, seems to raise more questions than it answers.

Instead, we could add nuance and context to our analysis by measuring the differences in wealth between racial groups within generational cohorts; or by comparing members of different groups who share key demographic characteristics; or even better still, by measuring the financial impact of policy interventions within specific groups.

For example, we could investigate the financial trajectories of young immigrants after they received Deferred Action for Childhood Arrivals (DACA) in 2012. Did they improve their income, build their savings, or even acquire appreciating assets, as compared with their peers? We could go further back in time and explore what happened to the generation of immigrants who were granted amnesty under the Immigration Reform and Control Act of 1986 (IRCA). What did emergence from the shadows mean for their assets and wealth? How does their wealth compare with those who remained undocumented?

These contextual comparisons can give us space not just to quantify what’s missing from people’s lives, but also to discover what works. Their creative survival strategies and rich cultural and social resources could help inform better policy interventions and program developments.

Bringing the story of new Americans into our conversations about wealth inequality will deepen our understanding of these disparities and the distinct forms they take for different groups. That’s what we need to develop bold policies—and to create innovative programs—to narrow the stark racial wealth divide we face today.