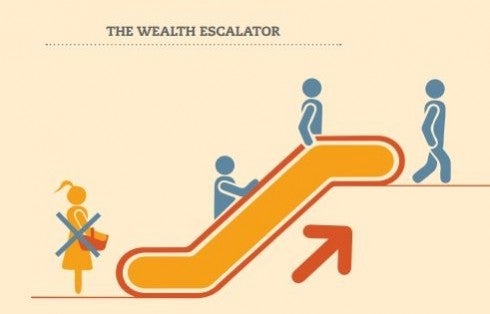

To this day, women still face persistent hurdles in the pursuit of gender equality. One hurdle that often gets overlooked but that has enormous implications for children, families, and society is the women’s wealth gap.

Unlike its relatively well-known cousin, the women’s wage gap, the wealth gap has largely flown below the public radar screen – no small feat given its magnitude. As sociologist Mariko Chang explains in a recent brief for the Asset Funders Network, while women earn an average of 77 cents for every dollar earned by men, they own a mere 32 cents compared to each dollar on their male counterparts’ balance sheet. When factoring in race, women’s wealth ownership statistics become so dire they almost defy belief. The median net worth of Latino women in the United States in 2013 was $100. For African American women, the median was $200. For single African American mothers, median wealth is $0, meaning that half of these parents have zero ability to cushion a financial blow or make an investment in their children’s future.

Source: http://www.mariko-chang.com/AFN_Women_and_Wealth_Brief_2015.pdf

One type of financial insecurity felt especially acutely among women is a lack of retirement preparedness. As former Senator Tom Harkin stressed at the Aspen Institute Financial Security Program’s (FSP) 2015 Financial Security Summit, retirement security “is the most under-reported crisis facing America… [and] women get a double whammy since they are concentrated in jobs that don’t offer a retirement plan, and because of unequal pay during their working years.”

The National Institute on Retirement Security (NIRS) recently released a report substantiating Harkin’s point. NIRS found that women are 80 percent more likely than men to be living in poverty upon reaching age 65. And while women are just as likely as their male counterparts to enroll in a 401(k) or other retirement plan when one is offered at work, rules limiting eligibility for part-time workers means that women – who make up two-thirds of the part-time labor force – are less likely to have the option.

Thankfully, this is not an intractable problem. Innovative policies could significantly curb the number of women with little to no savings. For example, better child care and sick leave benefits would help low-wage mothers, who today see their income decrease by 7% for each child they have. Moreover, family caregivers and homemakers – overwhelmingly women – do not get credit from Social Security for their work. Fixing this oversight, either with a tax credit, a Social Security credit, or both, would help these workers, who are often financially reliant on spouses and partners, build their own wealth. Policies that allow part-time workers to contribute to retirement savings plans, such as the Women’s Pension Protection Act , or open multiple employer plans with provisions that allow long-term part-time workers to contribute, could also go a long way in helping close this retirement gap. Finally, a number of states – California, Illinois, and Oregon, among others – are considering policies devised to automatically enroll workers in state-run Individual Retirement Accounts, which would be a boon for the millions of women who work for small businesses.

Of course, retirement security is only part of the wealth gap, which itself is only part of the inequality women face around the world. The World Economic Forum has found that, if current trends continue, true global gender parity – a composite measure of economic, health, political, and educational equality – won’t be achieved until 2133.

The Aspen Institute is committed to facilitating a dialogue around this pressing issue. That is why today the Institute is hosting a forum focused on women’s rights and economic justice that will underscore how we can foster a society that allows all women and girls to live productive, healthy, and self-sufficient lives. Aspen is also co-sponsoring a White House Summit on the United State of Women in Washington, DC later this year. Aspen FSP will continue to take these opportunities to shine a light on the women’s wealth gap and on what can be done to combat this pernicious social ill.

Back to the FSP homepage.