Latinx founders in the US are starting and growing businesses at a significant rate. According to the 2017 Kauffman report on early entrepreneurship, nearly one in four new businesses was Latino-owned as Latinxs are 1.7 times more likely to start businesses.

There is often more at stake for first-time entrepreneurs, immigrants, and first-generation Americans than simply building a profitable enterprise. The well-being of their families, intergenerational wealth creation, and upward social mobility are also on the table.

So when I think of an example of growing wealth through entrepreneurship, I think of my great aunt in Charcas, Mexico.

Nearly 40 years ago, in a small mining town in the state of San Luis Potosi, Pola Badillo, my great aunt, cut down the cactus patch behind her house and built a bakery. She scraped together money from her family, the church, and savings accumulated over several years. The most expensive part of the bakery was the oven — the construction, materials, and salaries of her sisters and daughters were negligible compared to the large iron oven that churned out pan dulce, cakes, and conchas until they had to upgrade it in the 1990s. That bakery put food on the dinner table for two generations of children. They eventually grew the bakery to three locations, specializing in wedding cakes, and they’re still in operation today.

My great aunt would never have received a termsheet from a venture capital firm with her business model. If she had a pitch, she would not have said her bakery was a platform for disrupting the consumer baked goods industry. She would not have projected hockey stick growth. There was no data play — it was a simple, ‘buy ingredients for a dollar and sell bread for two dollars’ model. The bakery was not a high-growth opportunity, but it was something that contributed to the town and paid out “dividends” to my family for decades.

My great aunt, just like many thousands of entrepreneurs that build local communities and national economies, needed financing that met her early-stage business where it was. And it would not have been Venture Capital.

Thanks to the popularity of TV shows like Silicon Valley and Shark Tank, everyone has heard of Venture Capital, though I’m not sure many people know what it is for. One of the first questions I hear from Latinx founders, is “How do I raise money for my business?” There are usually two key questions that are left out – Why should I raise money? What kind of money should I raise?

Venture capital is great for certain types of early stage companies, but the nature of this type of capital requires a REALLY fast, high-growth expectation. Like selling your company or going public with an Initial Public Offering, IPO, in 3-5 years. So if you think your company has the potential to grow to $100 million in revenue within a few years – VC is great! And VC makes perfect sense for many software companies.

VC-style funding has been moving into other areas that can capture similar software-style growth like hardware technology, consumer packaged goods, fashion & apparel, and business services – though without a software component to the business, capturing that level of growth is extremely difficult.

But, there are lots of different businesses in America – In fact, according to the US Small Business Administration, less than 1% of new companies in the United States receive venture style equity investments.

So where is risk-tolerant capital for the 99%?

I have good news and bad news for you. The bad news is that VC is (statistically) probably not the right type of financing mechanism for your business. The good news is that it’s ok – there are other types of financing, and they’ve been right in front of you all along!

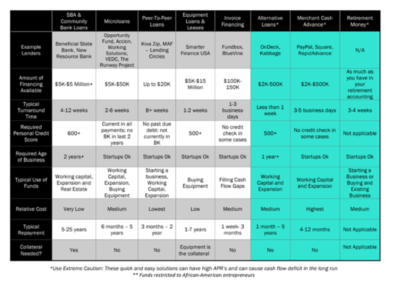

Courtesy of ICA Fund Good Jobs

Courtesy of ICA Fund Good Jobs

Pitch competitions

These are great for getting small amounts of non-dilutive capital (aka Prize Money). Here are two resources to help find local ones: Vator & Gary’s Guide. These options are great for idea-stage companies – to explain your vision and see if the judges and audiences agree that it’s the best.

Angel Investors

If you’ve done your research and come to the informed realization that you might need to bring in some equity investors for your early stage business, I’d recommend AngelList and the ACA as the best places to start for research. Angels are very risk-tolerant, and should be able to offer business advice as well.

Crowdfunding

There are a number of ways to run a successful crowdfunding campaign – which I highly encourage all entrepreneurs to research before signing up for anything! After you’ve done your research, I recommend Republic on the equity side and Indiegogo for the non-equity side, though there are many options out there. Crowdfunding is great for direct to consumer and/or product-focused companies.

Alternative Lenders

These are loans from different types of banks and non-banks that may meet your requirements. Lending Club’s small business loans are not incredibly expensive, and the Community Reinvestment Fund and the Opportunity Fund have affordable options as well. You can find Community Development Financial Institutions (CDFIs) near you here.

In the Bay Area, Working Solutions and Pacific Community Ventures offer small business loans. Additionally, for California residents, the CAMEO Microloan Program may be helpful as well. These lenders have different requirements, though they usually require the business to be in operation for some time, a certain FICO score of the business proprietor/founder, and financial information on the company.

Royalty-based loans

An underutilized alternative to a typical loan. Most of these funds need to see $750k in annual revenue before they commit, but Lighter Capital and Indie.vc are two that I can recommend checking out. They often are looking for software companies, though not exclusively.

All this being said, if you are a Latinx founder and you think your business has a chance to scale to be worth hundreds of millions of dollars in only a few years, please let me and my colleagues at Kapor Capital know. We have an open submission process to help non-traditional founders break through the biases of the warm introduction process that most VC’s require. So, drop us a note and let us know what you’re working on!