The past two years have been a time of extraordinary change and challenges for small businesses and the community development financial institutions (CDFIs) that finance them. Although the pandemic has taken a steep toll on small firms and the economic context remains uncertain, there are also signs of resilience and optimism. At the same time, while lenders have made dramatic shifts to respond to the pandemic and to participate in relief programs, financially they have fared much better than anticipated at the onset of the virus. As we neared the end of 2021, BOI and its Microfinance Impact Collaborative, comprising six of the largest CDFI microlenders, held discussions with key funders, investors, and partners on their experiences over the past two years and future expectations. We examined trends in small business activity and lending and the implications for MIC members’ work channeling capital to small businesses. Here are seven key takeaways from these discussions.

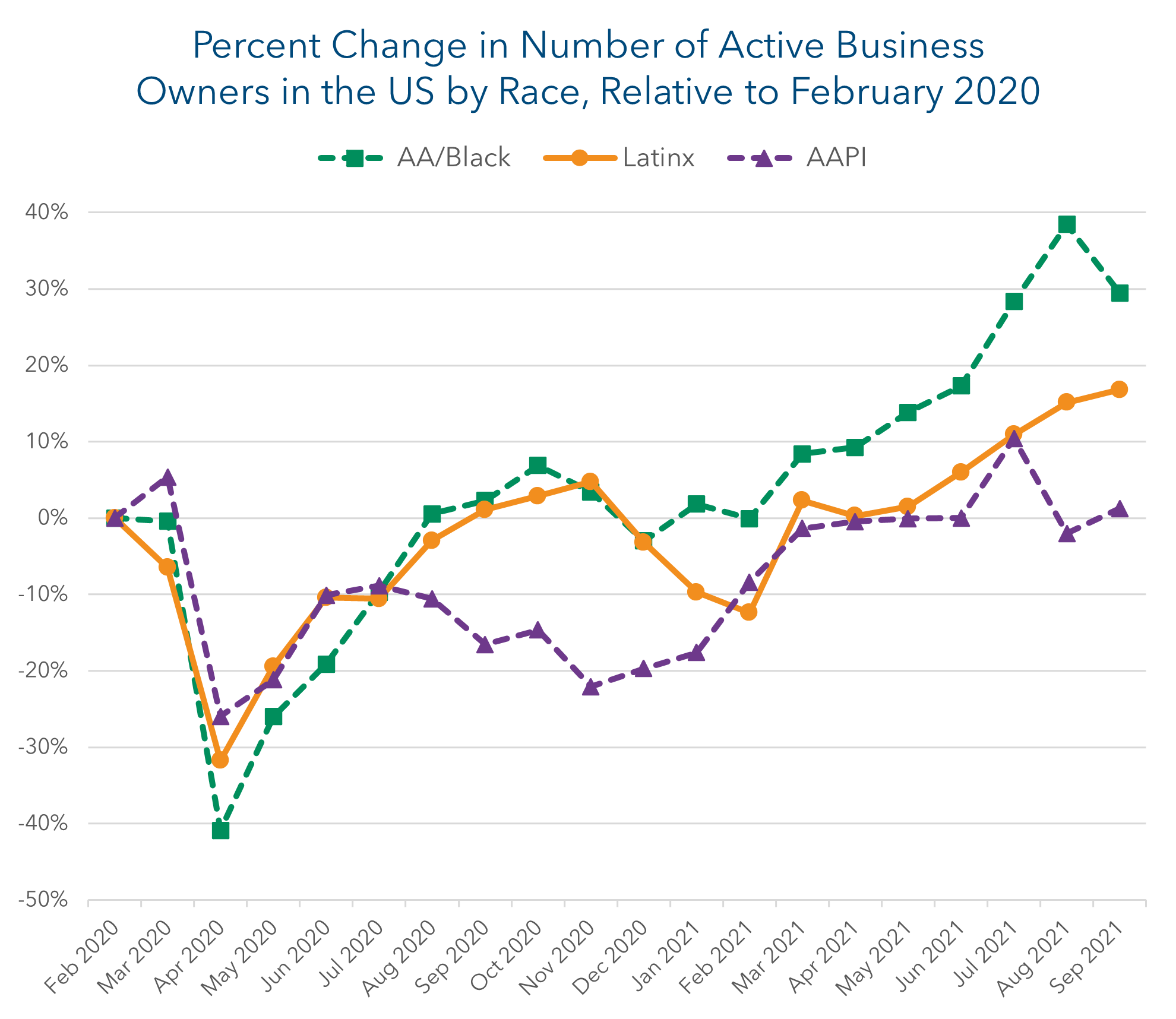

Finding 1: While 2020 brought high levels of temporary business closures among Black, Latino, and AAPI businesses, these trends have reversed, particularly among Black and Latino-owned firms.

The first months of the pandemic sent a huge shock through the small business sector, with many businesses forced to close due to public health requirements. The highest rate of small business closures occurred in April 2020, with the largest decline experienced by Black-owned businesses, which declined by 41%. However, as the immediate effects of pandemic shutdowns waned and small firms pivoted their operations, the number of operating Black, Latino, and AAPI small businesses increased, recovering to pre-pandemic levels by April 2021. Most notably, the numbers of Black and Latino-owned firms were significantly higher in September of 2021 than in pre-pandemic levels in February of 2020.

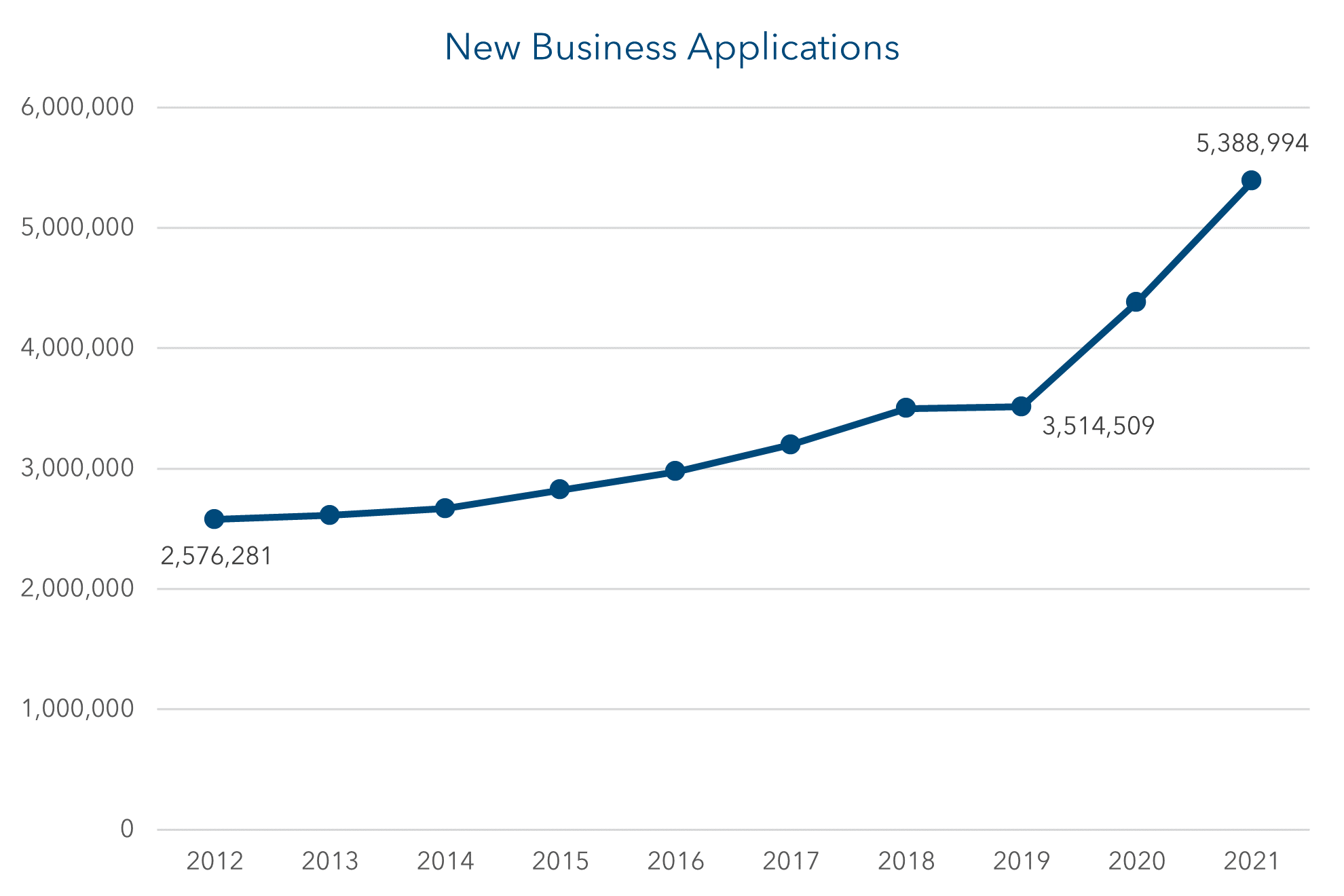

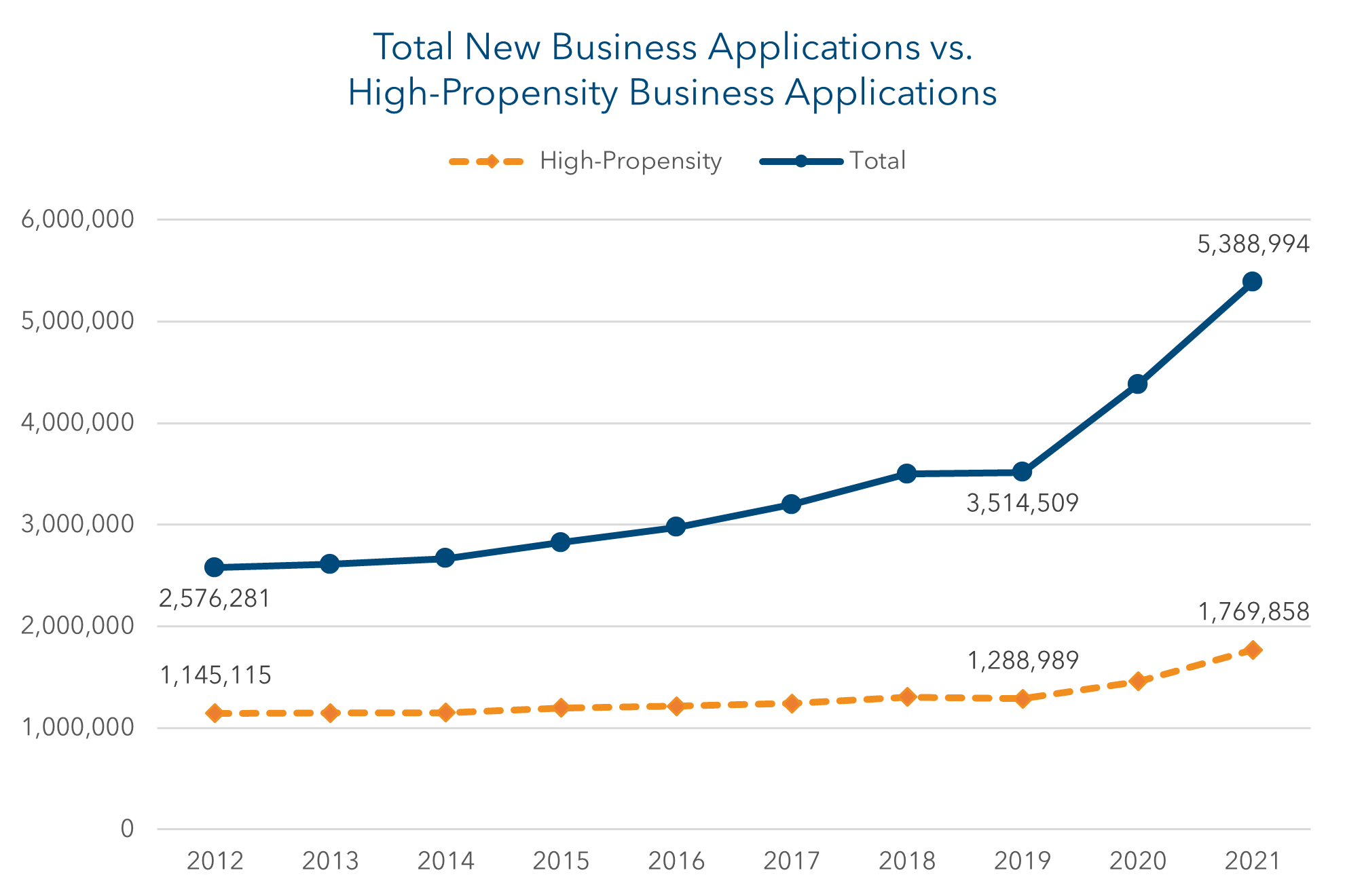

Finding 2: An unprecedented level of new startups has driven the growth in small firm ownership.

One of the critical factors driving the recovery in the number of small firms is an unprecedented increase in new business formations. According to the US Census Bureau’s data on new firm formations, between 2019 and 2021 the number of new business applications grew by almost 2 million. Startup rates often increase after economic recessions, but the recent rate of growth is very high even compared to the growth that occurred after the Great Recession. Growth in new business starts does not appear to be driven solely by individuals moved to self-employment because of job loss. Rather, the data also show a substantial increase in new firms that are likely to employ others. It’s also worth noting that many of the new firms are in sectors deeply affected by the pandemic, such as food, accommodation, and transportation. It’s unclear exactly what this means in terms of the viability of these firms in the continuing pandemic and after.

Finding 3: Small business loan performance was surprisingly strong during 2020 and 2021.

Overall, loan performance across business lenders (including banks and commercial finance companies) has been much stronger than was anticipated when the pandemic began. This is likely a result of pandemic relief and aid programs. Commercial bank small business loan performance trends show delinquency and charge-off rates increased from April to June of 2020 due to business closures. However, after June 2020, these rates trended downward so that by September of 2021 the net charge-off rate for banks was at its lowest point since 2011. Data from PayNet’s Small Business Default Index show similar trends for bank and alternative commercial lenders, although perhaps not surprisingly, loan performance varied by region and industry sector. The Paynet default index was highest in states most deeply affected by Covid-19 in the earliest phases of the pandemic, such as California, Texas, Florida, and New York. Similarly, loans to small businesses in the construction, retail, accommodation, and transportation sectors all had similar peaks in delinquency early in 2020 but are experiencing different levels of recovery.

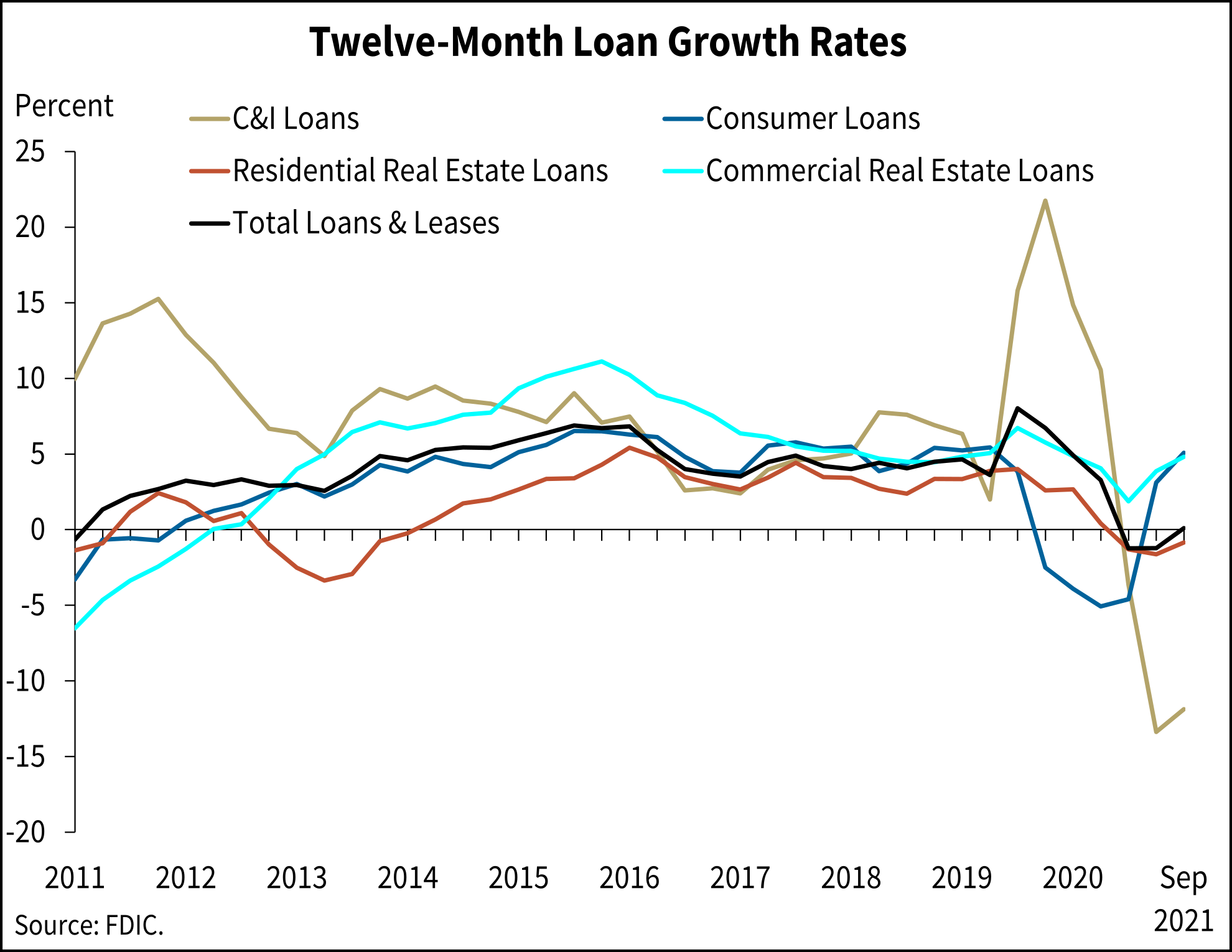

Finding 4: Small business lending by banks is contracting despite their financial health and strong growth in small firm creation.

While banks took a significant financial hit in the early stages of the recession—in part as they made major increases in their loss reserves—this trend reversed in 2021 as they released those reserves and saw significant increases in noninterest (fee) income. Despite bank earnings recovery, there is evidence banks are contracting their commercial and industrial lending volume for the first time since the last recession (see graph). The index of C&I lending dropped below zero percent late in 2020 and continued to be below -10% in September of 2021. Some observers expect C&I lending volume will continue to fall as banks will have difficulty underwriting businesses based on financials that were affected by the pandemic.

Finding 5: CDFI small business lenders have strong balance sheets and project growth in originations in 2022.

The balance sheets of the MIC member organizations are currently very strong. MIC members noted that their experiences with portfolio quality mirror those cited above for commercial lenders, as relief programs and proactive outreach to provide borrowers with payment relief and technical assistance protected portfolios. Furthermore, the increase in government, philanthropic and corporate investments in CDFIs has also strengthened balance sheets significantly. As trends point to shrinking C&I lending, MIC members are experiencing the residual effects and most currently have sufficient liquidity to lend into this credit void. Looking toward 2022, all the MIC members are expecting their originations to be substantially higher than pre-pandemic levels. However, if loan demand continues to be strong but banks remain wary of small business loans—particularly in smaller amounts—CDFIs will need additional injections of net assets and sources of liquidity to maintain this increased volume.

Finding 6: CDFI small business lending revenues are uncertain, particularly given changing expectations and uncertainties regarding interest rates.

Although there are indications of strong and growing small business loan demand, CDFIs face an uncertain revenue picture for 2022 due to a combination of two factors: the shrinking of on-balance sheet portfolios during 2020 and 2021 and changing borrower expectations about interest rates. MIC members saw their on-balance sheet loan portfolios shrink during the pandemic as much of their new originations came via relief programs such as the PPP. In these programs, CDFIs were compensated for originating new loans that were then forgiven or acquired by a special purpose vehicle; revenue from this lending came in the form of origination fees rather than ongoing interest payments. As these programs largely come to an end, CDFIs are shifting back to traditional lending.

As they plan their lending for 2022, CDFIs are less concerned about risk and more concerned about the effects of low-cost capital on borrowers’ price sensitivity and expectations of the cost of capital. Low-cost loans (with rates as low as 1%) and emergency grants available during the early stages of the pandemic have anchored small business owners’ expectations, even as inflation puts pressure on interest rates. In this context, CDFI small business lenders face the challenge of managing rates given that the smaller-dollar loans in greatest demand do not generate sufficient revenues to cover their costs—even at pre-pandemic interest rates. Thus, it will be the state of MIC members’ income statements rather than their balance sheets that will most impact their ability to meet loan demand during 2022.

Finding 7: Product innovation will be important in meeting credit demand.

In seeking to meet the new and changing demand from small businesses, MIC members are supplying more capital to startups – typically a relatively small part of many CDFI loan portfolios. They are also working to meet demand for new products, such as lines of credit and insurance. As institutions that have historically served entrepreneurs of color, women, and others excluded from traditional credit markets, MIC leaders understand they must continue to revamp processes, systems, and policies to meet these needs. However, investing in new product lines, technology, and process improvements is both costly and risky, and therefore requires resources in the form of operating grants, in addition to strong balance sheets.

Supporting CDFIs in financing small business recovery

As 2022 begins, MIC members are working to take action sufficient to the moment, while leaving flexibility to respond to still-changing circumstances. Although there are signs of optimism among some business owners, the pandemic and related policy context continue to impose economic risk and uncertainty. The greatest constraints that CDFI small business lenders will likely face relate to their ability to generate revenues needed to support future lending, especially if meeting demand requires product innovation and addressing changed expectations. Funders, investors, and policymakers concerned with meeting the needs of small firms—particularly those led by women and people of color—can best support their work by providing grant and operational funding to support the staffing and systems necessary to move the capital provided to CDFIs during the past years.

About the Microfinance Impact Collaborative

BOI’s Microfinance Impact Collaborative (MIC) works to strengthen and accelerate the efforts of US microenterprise finance organizations committed to significantly increasing the scale and impact of their work. Comprising six of the largest CDFI microlenders – Allies for Community Business, Ascendus, DreamSpring, Justine PETERSEN, LiftFund, and Accion Opportunity Fund – the collaborative provides a venue for collective learning and action. BOI and the MIC would like to thank Tammy Halevy and Renee Johnson of Reimagine Main Street and Brett Simmons of EBA Fund for their presentations at these meetings on key business and lending trends.

Share

Tweet It’s been a time of extraordinary change and challenges for small businesses and the community financial institutions that support them. What have we learned? Here are seven takeaways from @Aspen_BOI’s #Microfinance Impact Collaborative.

Tweet The pandemic took a toll on small businesses, but today there are signs of resilience and optimism. These seven key facts and challenges will be key to meeting #smallbusiness credit needs.

Tweet Although many businesses closed in early 2020, the number of businesses owned by entrepreneurs of color reached pre-pandemic levels just a year later. Check out six other facts and challenges from the #Microfinance Impact Collaborative.

Tweet Small businesses are recovering, and startups are driving this growth. New business applications increased by two million from 2019 to 2021. ? Read more from the #Microfinance Impact Collaborative.

Tweet The #Microfinance Impact Collaborative comprises six of the nation’s largest CDFI microlenders. Here are the challenges and opportunities they identified for 2022.