Background

Millions of Americans work as independent contractors, freelancers, and solo entrepreneurs.[1] A significant and stable portion of the workforce—around seven percent—relies on this type of independent work for their primary job.[2] Many more—as many as a third of working Americans—earn supplemental income through independent work.[3] And the number of people participating is rising: growth in the number of 1099 tax forms issued to independent workers has outpaced growth in the number of W-2s issued to traditional workers in the past decade, a trend the IRS expects to continue.[4]

Although independent workers experience high levels of autonomy and flexibility, they also face unique challenges, including unpredictable incomes, difficulty covering unexpected expenses, and limited access to employment-related benefits.[5] These challenges are exacerbated by a burdensome tax filing process. This proposal seeks to simplify tax filing for independent workers who receive 1099s, including independent contractors, sole proprietors, and many online-platform workers. In 2017, the National Taxpayer Advocate identified the lack of tax guidance for workers in the gig economy as one of the most serious problems facing American taxpayers.[6]

For individuals, taxes are a pay-as-you-go system designed primarily for workers in a traditional employment relationship. For these workers, employers withhold income and payroll taxes each pay period, and transmit them directly to the government. Each year, traditional employees receive a W-2 from their employers documenting income earned and taxes withheld. They file their taxes by April 15, and most receive a refund.[7]

For independent contractors, the tax system is much more difficult to navigate because there is no employer withholding taxes and often no reporting of income earned. Those with more than nominal tax liability are expected to predict their annual income and make estimated tax payments four times per year, facing irregular and often substantial tax bills.[8] They also must track and document expenses to deduct them from their gross pay in order to avoid paying taxes on their business expenses.

The complexities of tax filing for independent workers contribute to low rates of compliance and high costs for both workers and government. Lacking withholding and facing limited reporting requirements, independent workers are vastly less likely than traditional workers to accurately document their earnings for taxes. In fact, the IRS estimated that more than 40 percent of the total tax gap—the difference between taxes owed and taxes paid on time—from 2008 to 2010 was attributable to self-employed individuals underreporting their income. This underreporting equates to more than $190 billion in lost revenue per year.[9]

While many independent workers underreport their earnings, others overpay taxes by missing deductions and credits. Almost half of online-platform workers surveyed by the Kogod Tax Policy Center of American University reported being unaware of any deductions, expenses, and credits they were eligible for to lower their tax bills.[10]

This proposal targets the complexity of tax filing among independent workers. Its goals are to update the U.S. tax code to make the filing process simpler, to make independent workers’ income more transparent and comparable to that of traditional workers, and to increase tax compliance.

Proposal

This proposal has three provisions: expanded 1099 income reporting, tax withholding for independent work, and a Standard Business Deduction for independent workers. Collectively, these provisions would make it easier for independent workers to calculate and file their taxes and, as a consequence, increase tax compliance. These were inspired by a proposal by Kathleen DeLaney Thomas, Assistant Professor of Law at the University of North Carolina.[11]

1. Expanded income reporting

Traditional employees fill out a Form W-4 when they start a job, providing identifying information, and then receive a Form W-2 from their employer each year, documenting their wage or salary earnings and withholdings for their tax returns. In contrast, independent contractors fill out a Form W-9 for each entity that pays them. If their payment from that payer for the year exceeds a particular threshold, they receive a Form 1099 documenting those earnings.[12] That threshold varies depending on how they are paid. When paid directly in cash or check, they receive a Form 1099-MISC if they are paid at least $600. If paid electronically through a third-party payment network, though, they receive a Form 1099-K only if they are paid at least $20,000 and participate in over 200 transactions through that network.[13] Most online platforms that process payment for their service providers and sellers, including Uber, TaskRabbit, and Etsy, follow this higher threshold. However, independent contractors are responsible for filing and paying taxes on income below these thresholds, meaning many independent workers are expected to track and report earnings on their own without receiving documentation.[14]

Under this proposal, the reporting threshold for Form 1099-Ks issued by third-party settlement organizations would be lowered to $600 and 10 transactions, so that all independent contractors have similar reporting requirements regardless of whether they are paid directly in cash or check, or electronically through a third-party payment network, providing them earnings documentation to simplify their tax filing process. Massachusetts[15] and Vermont[16] both implemented $600 state-level 1099-K reporting thresholds in 2017. Policymakers may want to consider a higher threshold for third-party settlement organizations that act as marketplaces for goods, like PayPal and eBay, in order to avoid undue administrative burden for casual selling.

Aligning the 1099 reporting thresholds benefits the government and taxpayers. The IRS estimates that 63 percent of income is misreported when not subject to reporting requirements, compared to only 1 percent of income subject to substantial reporting and withholding.[17] Lowering the reporting threshold promises to increase tax compliance among independent workers and reduce the risk of penalties under an audit. Economic modeling conducted by District Economics Group (DEG) estimates that expanded reporting would increase federal tax receipts by between $112 million and $225 million annually, depending on compliance assumptions.

2. Tax withholding

Traditional employees have Social Security, Medicare, and income taxes withheld from their paychecks by their employer. When they file their taxes, they receive a refund if their tax bill is lower than their withheld earnings, or pay the difference if it is higher. Independent contractors, by contrast, have no taxes withheld. If they will owe the IRS more than $1,000 annually, they are required to estimate, file, and pay taxes four times per year.[18] If not, they often face a very large tax bill on April 15, which may include penalties for missing estimated payments through the year. This inefficient system is burdensome and often leads to unexpected, unpredictable tax bills, which can be particularly difficult given the income fluctuations many independent workers experience over the course of the year.

Under this proposal, certain payers would be required to withhold taxes on behalf of independent workers. Payers, which may include online platform companies, online marketplaces, or any other company that relies on independent contractors, would be subject to this requirement if the following three conditions apply:

- Payments to the independent contractor are over $600;

- The independent contractor is not an incorporated business,[19] as corporations have different tax filing requirements and procedures; and

- The payer is an incorporated business and issues at least 100 Form 1099s per year.

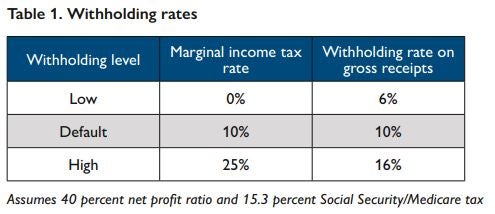

Independent workers are responsible for Social Security and Medicare taxes of 15.3 percent of their net earnings,[20] in addition to income tax, which ranges from 0 to more than 35 percent depending on annual income. Since they can deduct business expenses before taxes are calculated, they only pay taxes on a portion of the total amount they are paid. We apply a 40 percent profit ratio, estimating taxes on 40 percent of gross receipts.[21] Given these figures, withholding would default to a standard rate of 10 percent on all eligible gross receipts above $600, which approximates payroll taxes plus 10 percent income tax taken out of typical net income.[22]

For example, Sarah is paid $40,000 annually through a rideshare platform. Under the default withholding rate, she would have $3,940 withheld.[23] Subtracting typical expenses, her estimated net profit would be $16,000. With Social Security and Medicare taxes at 15.3 percent and an income tax of 12 percent,[24] she would owe $4,368 in taxes for this work. When she files her annual tax return, though, she would pay a much more reasonable $368, since the rest had been withheld over the course of the year. The 10 percent rate is likely to underwithhold for many taxpayers, like Sarah. However, it significantly lowers these workers’ tax burden while still allowing them the flexibility inherent to independent work and accommodating a range of profit margins.

Workers would have the option to raise or lower withholding to an alternative rate. If they expect to have low income, high expenses, or high itemized deductions, they could opt for a lower rate of 6 percent. If they expect to have higher income or low expenses, they could opt for a higher rate of 16 percent. Independent workers could indicate these preferences on the Form W-9 they fill out at the beginning of each job, similar to the allowances claimed on W-4s at the start of traditional employment. Having a choice between withholding rates allows workers some flexibility and is relatively simple for businesses to comply with. States would be urged to adopt a similar withholding system to align state and federal rules.

Withholding on 1099 income has been suggested by the National Taxpayer Advocate[25] and the Government Accountability Office.[26] It would simplify tax filing for many independent contractors by eliminating the need to estimate and file taxes quarterly, reducing unexpected tax bills and facilitating financial planning for these workers. Withholding would also make it easier for independent workers to understand their net pay in a way that is more comparable to that of traditional workers. Lastly, it promises to increase tax compliance, as income subject to withholding has the lowest rates of underreporting.[27] Economic modeling conducted by DEG predicts withholding on online platform income alone at the minimum rate of 6 percent would raise at least $293 million in its first year, and an additional $220 million in each subsequent year. Although only a small portion of the total tax gap resulting from self-employed taxpayers, introducing withholding for this population is an important initial step in addressing the problem.

3. Standard Business Deduction

One of the most complex aspects of filing taxes as an independent contractor is tracking and deducting business expenses to determine taxable income. Independent workers report the full amount they were paid—their gross receipts—on Schedule C of their tax return. They then identify and subtract each expense incurred while working, including purchased supplies, vehicle costs, commissions and fees, and other expenses, in order to calculate their net income—a time consuming and tedious process, especially for those without accounting expertise. On one survey of platform workers, 36 percent said they did not understand the records they needed to keep in order to track expenses.[28]

To ease the burden of filing for these individuals, this proposal suggests a Standard Business Deduction (SBD) that could be used by eligible independent contractors in lieu of deducting actual business expenses from their gross receipts. If they chose to use the SBD, eligible workers would simply deduct 20 percent of their gross receipts, in addition to service fees, to estimate their net income.[29] The SBD is comparable to the personal standard deduction, which allows taxpayers to take a flat deduction instead of claiming itemized personal deductions, like mortgage interest or charitable donations. The intention of this provision is not to provide a tax break to independent workers, but rather to provide a simple option for deducting approximate business expenses.[30]

Income reported on Form 1099-MISC or 1099-K would be eligible for the SBD if:

- The taxpayer’s gross business receipts do not exceed $100,000; and

- The taxpayer’s overall Adjusted Gross Income does not exceed $150,000 with the SBD.

The SBD simplifies the tax filing process for independent workers by reducing the time and expertise needed to file accurately. Economic modeling by DEG estimates an SBD of 20 percent would cost approximately $546 million annually.

Conclusion

Together, these provisions promise to reduce the complexity of tax filing for millions of workers and increase tax compliance for government. Under very conservative assumptions, economic modeling predicts that expanding reporting and withholding will increase revenues between $300 and $500 million per year. In addition to raising revenues, these provisions represent an important step in developing policies that address the problem of underreporting among independent workers. The Standard Business Deduction as proposed is predicted to cost just over $500 million annually. Policymakers may want to consider further analysis of independent workers’ business deductions to arrive at a different rate, or tiered deduction rates for different industries, in order to reduce the cost of this provision while retaining the simplification of a standard deduction.

Even with these proposals, tax filing will present challenges to many workers, and policymakers may want to consider expanding funding for Volunteer Income Tax Assistance (VITA) sites and training for tax advisors in order to provide further assistance. We need a comprehensive approach to simplifying tax filing and improving the financial health of independent workers.

[1] For a detailed look at different definitions of independent work, see the Gig Economy Data Hub. https://www.gigeconomydata.org/basics

[2] U.S. Bureau of Labor Statistics. 2018. “Contingent and Alternative Employment Arrangements – May 2017.” U.S. Department of Labor. June 7. https://www.bls.gov/news.release/pdf/conemp.pdf.

[3] Larrimore, Jeff, Alex Durante, Kimberly Kreiss, Christina Park, and Claudia Sahm. 2018. “Report on the Economic Well-Being of U.S. Households.” Board of Governors of the Federal Reserve System. May. https://www.federalreserve.gov/publications/files/2017-report-economic-well-being-us-households-201805.pdf.

[4] Dourado, Eli, and Christopher Koopman. 2015. “Evaluating the Growth of the 1099 Workforce.” Mercatus Center at George Mason University. December. https://www.mercatus.org/system/files/Evaluating-Growth-1099_Dourado_MOP_v2.pdf; Jackson, Emilie, Adam Looney, and Shanthi Ramnath. 2017. “The Rise of Alternative Work Arrangements: Evidence and Implications for Tax Filing and Benefit Coverage.” U.S. Department of the Treasury. January. https://www.treasury.gov/resource-center/tax-policy/tax-analysis/Documents/WP-114.pdf; U.S. Internal Revenue Service. 2018. “Calendar Year Projections of Information and Withholding Documents for the United States and IRS Campuses, 2018 Update.” Publication 6961. https://www.irs.gov/pub/irs-soi/p6961.pdf.

[5] Freelancers Union and Upwork. 2017. “Freelancing in America: 2017.” https://www.upwork.com/i/freelancing-in-america/2017/; MBO Partners. 2018. “The State of Independence in America.” https://www.mbopartners.com/state-of-independence; Prudential. 2017. “Gig Workers in America – Profiles, Mindsets, and Financial Wellness.” https://www.prudential.com/media/managed/documents/rp/Gig_Economy_Whitepaper.pdf.

[6] IRS Taxpayer Advocate Service. 2017. “Sharing Economy: Participants in the Sharing Economy Lack Adequate Guidance From the IRS.” 2017 Annual Report to Congress. https://taxpayeradvocate.irs.gov/Media/Default/Documents/2017-ARC/ARC17_Volume1_MSP_14_SharingEconomy.pdf.

[7] 75 percent of filers receive a refund in 2017. U.S. Internal Revenue Service. 2017. “Filing Season Statistics for Week Ending September 1, 2017.” https://www.irs.gov/newsroom/filing-season-statistics-for-week-ending-september-1-2017.

[8] Currently, quarterly tax payment deadlines are not distributed evenly throughout the year. Policymakers should consider adjusting these dates to align with fiscal quarters for simplified accounting, as proposed in Section 305 of S. 3278, the Protecting Taxpayers Act of 2018 introduced by Sen. Rob Portman (R-OH). https://www.congress.gov/bill/115th-congress/senate-bill/3278.

[9] The sum of underreported individual business income tax, underreported self-employment tax, and unfiled self-employment tax. U.S. Internal Revenue Service. 2016. “Federal Tax Compliance Research: Tax Gap Estimates for Tax Years 2008–2010.” Publication 1415. May. https://www.irs.gov/pub/irs-soi/p1415.pdf.

[10] Bruckner, Caroline. 2016. “Shortchanged: The Tax Compliance Challenges of Small Business Operators Driving the On-Demand Platform Economy.” Kogod Tax Policy Center at American University. May. https://www.american.edu/kogod/research/upload/shortchanged.pdf.

[11]For details of that proposal, see DeLaney Thomas, Kathleen. 2018. “Taxing the Gig Economy.” 166 University of Pennsylvania Law Review 1415. UNC Legal Studies Research Paper. June 8. https://ssrn.com/abstract=2894394.

[12] A copy of the Form 1099 is also sent to the IRS.

[13] Form 1099-K is issued by both merchant acquiring entities and third-party settlement organizations (TPSOs). Merchant acquiring entities process electronic payments directly to the payee, like credit card companies. TPSOs process electronic payment on behalf of the payer and then pay the payee, like an online platform or marketplace. The current Internal Revenue Code (Section 6050W) only specifies a threshold for TPSOs, and this proposal maintains that differentiation, recommending a $600 threshold for TPSOs and not specifying a threshold for merchant acquiring entities.

[14] Individuals are responsible for income tax if they meet the requirements specified in IRS Form 1040 instructions, which for most single taxpayers means at least $10,400 of gross income from all sources. Individuals are responsible for paying self-employment tax if they have a net income from self-employment greater than $400. The $600 reporting threshold refers to gross payments. Given average profit margins of independent workers, the $600 gross payment and $400 self-employment tax thresholds are aligned, leaving few taxpayers in the position of being expected to file taxes on income for which they did not receive a 1099. Policymakers may want to consider adjusting the self-employment tax threshold to even better align with the reporting threshold. More information on income filing requirements can be found in: U.S. Internal Revenue Service. 2018. “2017 1040 Instructions.” February. https://www.irs.gov/pub/irs-pdf/i1040gi.pdf.

[15]Commonwealth of Massachusetts. 2017. TIR 17-11: New Massachusetts Reporting Requirements for Third Party Settlement Organizations. November 29. https://www.mass.gov/technical-information-release/tir-17-11-new-massachusetts-reporting-requirements-for-third-party.

[16]State of Vermont. 2017. New Law Lowers Reporting Threshold for 1099-K Information Reporting. December 19. http://tax.vermont.gov/news/1099-k-information-reporting.

[17] U.S. Internal Revenue Service. 2016. “Federal Tax Compliance Research: Tax Gap Estimates for Tax Years 2008–2010.” Publication 1415. May. https://www.irs.gov/pub/irs-soi/p1415.pdf.

[18] These are often referred to as quarterly payments, although the deadlines are not evenly distributed over the year, falling in April, June, September, and January. In addition, state and federal intervals are not always aligned, meaning many individuals must keep track of as many as eight deadlines that do not correspond with traditional fiscal quarters.

[19] Sole proprietors, including Limited Liability Corporations (LLCs) taxed as sole proprietors, are included. Corporations, including LLCs taxed as S Corporations, are excluded.

[20] Independent contractors are responsible for both the employee and employer portion of these payroll taxes, so this figure is twice as much as traditional employees’ payroll taxes.

[21] We adopt Kathleen DeLaney Thomas’ calculation of the average weighted net profit ratio of sectors “most likely to encompass gig workers and other small independent contractors” using 2014 IRS data. Overall, calculations of profit ratios vary from just over 20 to nearly 50 percent, depending on the definitions used. See Delaney Thomas, Kathleen. 2018. “Taxing the Gig Economy.” 166 University of Pennsylvania Law Review 1415. UNC Legal Studies Research Paper. June 8. https://ssrn.com/abstract=2894394.

[22] (10% withholding on gross receipts) = [(10% income tax) + (15% payroll tax)] x (40% net profit)

[23] Withholding only begins once an individual has been paid $600, so it applies to Sarah’s gross receipts after the first $600, or $39,400 ($40,000-$600).

[24] Assuming this worker was single with a total annual income less than $38,700.

[25] IRS Taxpayer Advocate Service. 2003. 2003 Annual Report to Congress. December 31. https://www.irs.gov/pub/irs-utl/nta_2003_annual_update_mcw_1-15-042.pdf.

[26] U.S. Government Accountability Office. 2007. Tax Gap: A Strategy for Reducing the Gap Should Include Options for Addressing Sole Proprietor Noncompliance.” July. https://www.gao.gov/assets/270/265399.pdf.

[27] U.S. Internal Revenue Service. 2016. “Federal Tax Compliance Research: Tax Gap Estimates for Tax Years 2008–2010.” Publication 1415. May. https://www.irs.gov/pub/irs-soi/p1415.pdf.

[28] Bruckner, Caroline. 2016. “Shortchanged: The Tax Compliance Challenges of Small Business Operators Driving the On-Demand Platform Economy.” Kogod Tax Policy Center at American University. May. https://www.american.edu/kogod/research/upload/shortchanged.pdf.

[29] Calculations of average expense ratios vary from just over 50 percent to more than 75 percent. The 40 percent profit ratio used for the withholding provision, for example, would equate to an expense ratio of 60 percent. Given the range of expenses between industries and between individual workers within industries, it is impossible to identify one standard rate that accurately reflects expense ratios for all workers. We select 20 percent as a conservative estimate that would minimize over-deduction while giving independent workers a simpler option for tracking expenses. Those with higher expense ratios would of course be able to continue to itemize and deduct actual expenses.

[30] Policymakers may want to consider limiting independent workers in specified service industries to taking either the SBD or the 199A deduction of the Tax Cuts and Jobs Act of 2017. The 199A deduction is intended to provide a tax break to sole proprietors, partnerships, and S-corporations, and allows these entities to exclude up to 20 percent of their business income from federal income tax. For filers earning about $157,500, it excludes income from specified service industries, including health, law, accounting, performing arts, and financial services. These industries tend to have relatively low expenses, and so limiting filers to one of these two deductions prevents them from receiving an outsized tax break.