Each July, the Aspen Institute’s Resnick Aspen Action Forum brings Fellows of the Aspen Global Leadership Network (AGLN) and leaders from around the globe to Colorado for a week. Through authentic dialogue, knowledge sharing, and community building, participants develop new perspectives and connections that will help them generate solutions to complex global issues.

This year, inclusive economic growth had a starring role, as the program included a gathering of the Global Inclusive Growth Spark Grant Awardees. These grants—supported by the Mastercard Center for Inclusive Growth as part of the Aspen Partnership for Inclusive Economy—provide catalytic funding to up to four grant recipients, with award amounts totaling $60,000. In previous years, they’ve supported leaders like Ashley Bell of the National Black Bank Foundation, who you can hear in this inspiring video.

Who they are:

For three years, grants have gone to values-driven leaders—Fellows in the AGLN from around the globe—who are powering initiatives to reimagine more inclusive economic futures for all.

What they’re doing:

- Promoting financial security and resiliency of small business

- Supporting the economic mobility of workers, specifically through reimagining public and private benefit

- Leveraging the power of data for good

- Reinvigorating neighborhoods to build economically prosperous communities

Who’s next:

The deadline to apply for next year’s grants is September 2. Applicants must be AGLN fellowswho have taken part in one of AGLN’s regional or sector-based leadership initiatives, and are ready to dedicate time and energy to making a difference in society using their skills, passions, networks, and platform to launch a leadership venture.

Learn more, starting with this post.

Here’s Why Americans Can’t Stop Living Paycheck to Paycheck

“There are millions of people struggling,” says the Institute’s Ida Rademacher in a recent explainer video for CNBC. “If you are in a place where your financial security seems super precarious, you are not alone—and it’s not your fault.” Rademacher, co-executive director of the Financial Security Program, is one of several experts who explain the financial forces behind a pervasive feeling of budgetary unease.

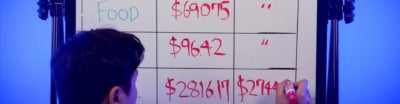

The usual suspects are there—the high costs of housing, education, and out-of-pocket medical care eat up 82% of the average renter’s take-home pay—and inflation and high interest rates are also affecting the equation. The video breaks down the numbers whiteboard-style, showing that for most of us, income just isn’t keeping up with expenditures. And it’s not that we’re not trying.

“There are many, many households who do the verb of “saving”; you see money go into their account all the time,” says Rademacher. “It just doesn’t stay there because they are routinely hit with a need to grab that little bit of money and use it for some kind of income shock or unexpected expense… or even expected expense.”

Social Security is on Life Support. Here’s How to Get it to its 100th Birthday.

Social Security turned 88 last week, and reports of its demise are only mildly exaggerated. Its trust fund, notably, will run dry in just a decade if Congress doesn’t act. “Social Security’s looming fiscal crisis has been well understood and expected for decades,” writes Mark Dugganin an op-ed for The Hill. “It is primarily driven by a steadily declining ratio of workers to retirees resulting from lower fertility rates and rising life expectancies.”

The program is vital to the nation’s financial health; one in five Americans—67 million of us—are currently receiving benefits. Duggan has a plan to save it, based on four principles:

- Current Social Security recipients or those likely to soon claim benefits would not experience any benefit changes, which they could not have planned for.

- Rather than uniform across-the-board changes, the plan targets the affluent for most tax and benefit changes.

- The reductions in benefits are phased in gradually, giving workers sufficient time to prepare.

- The proposed changes are very simple and would put Social Security on a solid financial footing for many years to come.

That plan—a package of five reforms—will be released in the coming weeks through the Aspen Economic Strategy Group.

While you’re waiting, read the op-ed here.

This piece was originally published in APIE’s newsletter ‘The Weekly Slice’. Click here to subscribe.