The Aspen Institute Financial Security Program convened its fourth annual Leadership Forum on Retirement Savings in early March 2020. At the time, the scope of the coronavirus was just beginning to be understood. Now, as this report is published, we find ourselves in the midst of a full-blown global pandemic, which has led to economic crisis and income loss for millions of Americans. In the interim, the protests following the May 25th killing of George Floyd ignited an overdue societal conversation about systemic racism and the systems that we must improve so that all Americans have the chance to lead dignified lives.

The Forum’s 70-plus participants from diverse sectors were more certain than ever that although the current retirement system has helped millions reach a more secure future, the three pillars that comprise traditional retirement planning—employer-funded pensions, personal savings, and Social Security benefits—fail to provide adequate financial protection to a persistently large segment of the population. In fact, a large swath of the U.S. workforce, particularly those with low incomes and people of color, continues to lack both emergency savings and access to any form of workplace retirement savings. The emergence of COVID-19 and the gaps in the safety net it has exposed has put the financial insecurity of the American household into sharper relief.

By Forum’s end, four priorities emerged as design principles essential to creating a more robust, inclusive and practical retirement savings ecosystem for people across America. Given the current crisis, the timetable for implementing these priorities has become that much more urgent.

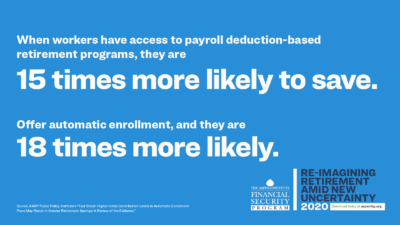

- Provide universal access to automatic enrollment in workplace retirement savings.

- Help workers build liquid emergency savings alongside their retirement savings.

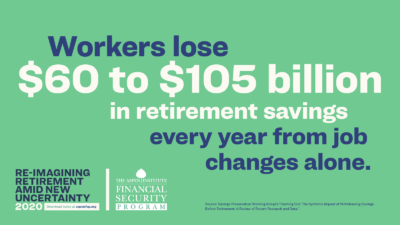

- Make retirement savings portable.

- Innovate to create lifetime income streams for everyone.

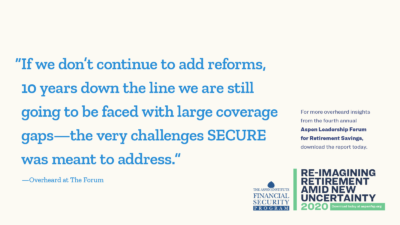

Almost halfway through the Aspen Leadership Forum on Retirement Savings’ planned 10-year journey, two things have become clear: systemic change is needed across a range of issues, and that systemic change will require collaboration and action from both the private and public sectors.

Key Findings