Because business ownership has been a means for many Americans to build wealth, providing loans and grants to entrepreneurs of color has been seen by many as an important way to address the racial wealth gap. Although successfully reaching excluded entrepreneurs will require practices and competencies that meet their specific contexts, the lessons we have learned and practices that have proven successful will apply to all entrepreneurs who face barriers in accessing credit because of low levels of wealth, thin or nonexistent credit files, differences in cultural experiences and languages, discrimination, and/or the amount of credit they are seeking. This brief — the first in a series on this topic — discusses the core operational challenges that community development financial institutions (CDFIs) face in scaling their lending to entrepreneurs of color.

Share

Tweet Brief: “Scaling Lending to #Entrepreneurs of Color: Part I – Core Operational Challenges” by Joyce Klein (@Aspen_BOI), @ericthefez, and @timothyogden (@financialaccess).

Tweet What will it take for #CDFIs to reach more #smallbiz owners of color? Joyce Klein (@Aspen_BOI), @ericthefez, and @timothyogden (@financialaccess) tackle this question and more.

Tweet Meeting the financing needs of #entrepreneurs of color is critical to ensuring the health of #smallbiz and living up to commitments to address racial inequities. Joyce Klein @Aspen_BOI, @ericthefez, and @timothyogden discuss how to do that.

Tweet Because of systemic racism, the most common financing options are rarely available to #entrepreneurs of color. Hence the importance of #CDFI microloans. More from Joyce Klein (@Aspen_BOI), @ericthefez, and @timothyogden (@financialaccess).

Tweet Despite the challenges posed by structural racism, between 2014 and 2018, Black and Latinx Americans had a higher rate of #entrepreneurship than their white counterparts. Read more from Joyce Klein @Aspen_BOI, @ericthefez, and @timothyogden.

Tweet #Microloans are the financing product that could reach the greatest number of Black and Latinx #entrepreneurs. Read more in this brief by Joyce Klein (@Aspen_BOI), @ericthefez, and @timothyogden (@financialaccess).

Videos

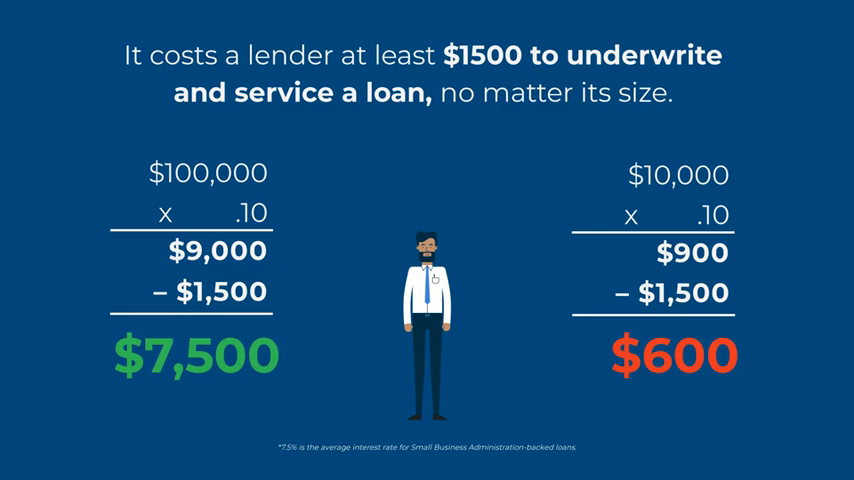

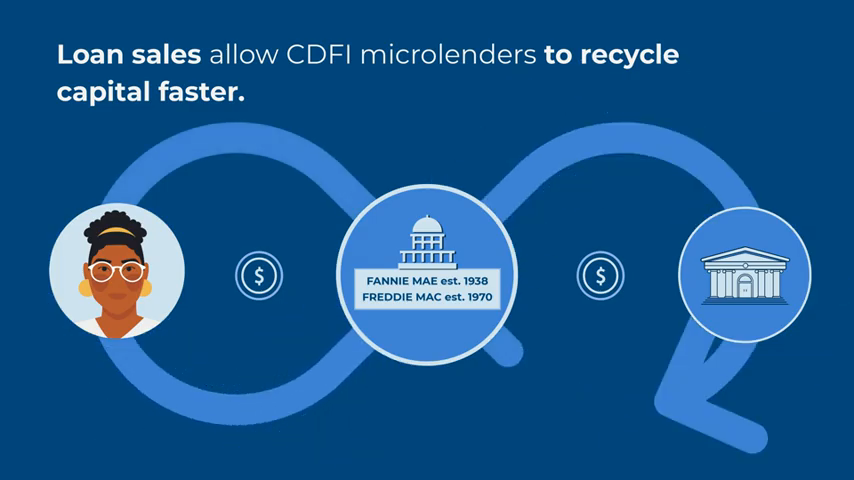

We recently released two short videos on this subject, including Getting Capital to Small Businesses in Low-Income Communities and How Loans Sales Can Boost Lending to Low-Income Communities. Click below to watch.

Getting Capital to Small Businesses in Low-Income Communities

How Loans Sales Can Boost Lending to Low-Income Communities

Scaling Lending to Entrepreneurs of Color

- Program: Microlending Accelerator Program

- Publication: Scaling Lending to Entrepreneurs of Color: Part I – Core Operational Challenges

- Publication: Scaling Lending to Entrepreneurs of Color: Part II – Strategies and Operational Tactics for High-Volume Originations

- Video: Scaling Lending to Entrepreneurs of Color

- Blog Post: Two New BOI Resources on Scaling Lending to Entrepreneurs of Color

Learn More

The Business Ownership Initiative works to build understanding and strengthen the role of business ownership as an economic opportunity strategy. BOI is an initiative of the Economic Opportunities Program.

The Economic Opportunities Program advances strategies, policies, and ideas to help low- and moderate-income people thrive in a changing economy. Follow us on social media and join our mailing list to stay up-to-date on publications, blog posts, events, and other announcements.