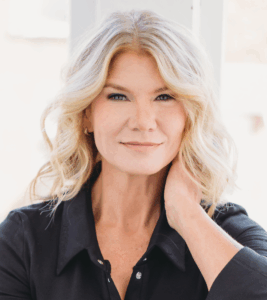

On March 29, 2022, Vice President at the Aspen Institute and Executive Director of the Financial Security Program, Ida Rademacher, testified before the Senate Health, Education, Labor, and Pension Committee. The hearing, titled “Rise and Shine: Improving Retirement and Enhancing Savings” took a broader look at how to strengthen both our existing retirement system and savings for all Americans.

Retirement Savings is a Pillar of the Future of Wealth

Retirement savings are one of the largest sources of household wealth in the United States, second only to home equity in its overall asset value on an average American household balance sheet. This wealth-building potential is important not just for the rich—everyone needs wealth to thrive. Not having wealth leaves people less able to invest in economic mobility; support family, community, and future generations; care for their health and well-being; and feel a sense of control and dignity in life. For a large share of people and families in America, wealth is out of reach – and without it, financial security is nearly impossible. Too often conversations about retirement savings carry an implicit or explicit assumption that low- or moderate-income Americans don’t need savings because Social Security replaces much of their income. But given the critical role of wealth in the quality of life and goals that all households have, that claim is clearly false. It is essential that we build a retirement savings system that works for everyone.Unfortunately, while many are able to effectively invest in retirement savings, far too many others do not have access to this powerful system. Account ownership and balances are distributed unevenly across socioeconomic groups, racial groups, generations, and gender.

Far Too Many Lack Access to Workplace Retirement Savings

Approximately 40 million workers in America currently lack access to a workplace retirement savings plan. In addition to leaving millions of workers without sufficient resources upon retirement, these gaps in retirement plan access contribute to growing wealth inequality in the United States. In 2016 the typical Black household had 46 percent of the retirement wealth of the typical white household, and the typical Hispanic/Latino household had 49 percent of the retirement wealth of a white household. There is a generational wealth divide as well. Americans born in the 1960s have accumulated 11 percent less wealth than earlier generations at a similar age, while those born in the 1970s have an average of 18 percent less. Those born in the 1980s are 34 percent less wealthy than expected.Women also face retirement savings hurdles higher than those of men. Women are less wealthy overall than men, owning 32 cents on every dollar owned by men. They are also much more likely than men to have part-time jobs, which are about half as likely to offer a retirement savings benefit. Consequently, it is unsurprising that the pandemic hit female savers hard. During the pandemic, just 41 percent of women said they would be able to continue saving for their retirement compared to 58 percent of men.In her testimony, Rademacher highlighted some solutions for policymakers to address accessibility gaps, including increasing the number of part-time workers who have access to retirement plans at work, expanding the market for Multiple/Pooled Employer Plans (that have the potential to make offering retirement plans cheaper for smaller employers) to include workers at nonprofit organizations, and promoting automatic re-enrollment in retirement plans.

Lack of Portability of Retirement Savings Leaves the System in the 20th Century

At the hearing, Rademacher also discussed how a lack of portability of retirement savings leaves the system in the 20th century.The average worker changes jobs 12 times over the course of a career, and those with access to 401(k) plans are faced each time with rolling over or cashing out their savings. Lost savings from job changes alone total between $60 billion and $105 billion each year. One solution proposed at the hearing could be to create an online “lost and found” database to help workers locate their 401(k) accounts as they switch jobs and can provide a meaningful opportunity to help account holders in finding the more than 16 million abandoned retirement savings accounts.

Innovation is Needed to Create Lifetime Income Streams in Retirement for All

The ability to build wealth provides economic resilience, enables investments in mobility, provides a foundation for intergenerational support, and contributes to people’s overall health and quality of life. But, Americans lack equal access to both the financial stability required for wealth building and the tools that can turn those resources into durable wealth, especially during retirement. Social Security is the core of the monthly regular income stream for the majority of American retirees, but research from the Congressional Budget Office shows Social Security replaces less than half of pre-retirement wages for the typical worker. Rademacher’s testimony emphasized how retirement savings can supplement Social Security to provide routinely positive cash flow.

Emergency Savings is a Promising Solution to Protect Financial Security and Safeguard Retirement Savings

Finally, Rademacher discussed how emergency savings can be a promising solution to protecting financial security and safeguarding retirement savings. In 2017 researchers at the Consumer Financial Protection Bureau (CFPB) found that having short-term, liquid savings to smooth volatile income and expenses or to cover unexpected financial emergencies was the single factor most highly correlated with household financial well-being. A 2022 study by the CFPB confirmed the importance of emergency savings, finding that households with emergency savings were substantially less likely to overdraft, take on high-interest debt, or withdraw early from their retirement savings.Our research has also found that emergency savings were a particularly important lifeline for families during the economic crisis caused by Covid-19, with 73 percent of Americans reporting a reduction in their income during 2020. A recent survey we conducted with Morningstar, the Defined Contribution Institutional Investment Association, and NORC at the University of Chicago found that families who had emergency savings before the pandemic were much better able to maintain their financial health than those who did not.We also found that emergency savings were very effective in safeguarding against retirement withdrawals: households with at least $1,000 in emergency savings were half as likely to withdraw from their workplace retirement savings accounts.Existing emergency savings solutions do not meet the needs of millions of people, and it is difficult for financial services providers to profitably offer low-balance savings accounts and frequent contributions and withdrawals. Policymakers can ensure that emergency savings policy solutions support the preservation and accumulation of retirement funds and do not inadvertently incentivize leakage from retirement savings. Rademacher’s remarks emphasized how this can be done through existing policy opportunities that allow for automatic enrollment in workplace emergency savings accounts and around enhancing tax time savings opportunities.

Conclusion

These are bipartisan, incremental steps toward closing the access gap for retirement savings and preserving household savings. Much more change will be needed to truly close those gaps, but improvements like these can lay the bipartisan foundation for future improvements to achieve true inclusion in the retirement savings system.

The full testimony is available to download below, along with additional resources on retirement and emergency savings solutions:

Foundations of a New Wealth Agenda: A Research Primer on Wealth Building for All

Expanding Worker Access to Automatic Enrollment in Retirement Savings

Strengthening and Steadying Cash Flow in Retirement

Centering Racial Equity and Wealth Building in an Inclusive Retirement Savings System

Building User-Centric, Portable Retirement Savings Tools for the 21st Century Workforce