This guest blog is part of a series on different perspectives related to the Financial Security Program’s event, Should They Stay or Should They Go? Reexamining Retirement Tax Incentives.

Peter J. Brady is a senior economist at ICI.

What if you were given the task of designing a retirement system from scratch? In a RECENT PAPER, New York University law professor David Kamin proposes a retirement system that combines a mandatory savings floor with tax incentives to encourage savings above the mandated minimum. He is not the first to propose a new mandatory retirement plan, with others proposing that either EMPLOYERS BE REQUIRED TO OFFER A PLAN or WORKERS BE REQUIRED TO CONTRIBUTE TO A PLAN.

I recently appeared on a panel at the Aspen Institute to discuss David’s paper and noted that my ideal retirement system would have much in common with the one he proposes. It would have two components: a mandatory component which would establish a minimum level of income for retirees; and a completely voluntary component, where workers could have a portion of their compensation set aside on a tax-deferred basis for retirement.

A Reflection on What We Already Have

If this sounds vaguely familiar, it’s likely because it describes the retirement system we already have.

Social Security is the mandatory component. It is a retirement plan that covers all workers; is funded by mandatory contributions, in the form of payroll taxes, equal to 12.4 percent of pay; and provides benefits based on a worker’s average earnings.

The voluntary component is the employer plan system. Employers have the option to establish a retirement plan of their choosing—defined benefit (DB) or defined contribution (DC), funded with employer contributions or employee contributions. And the tax code treats all of these plans the same—that is, WORKERS PAY NO TAX UNTIL THEY TAKE A DISTRIBUTION FROM THE PLAN.

The question raised by proposals such as David’s is not whether the United States should establish a mandatory retirement plan. It’s whether the United States should have two—Social Security plus another mandatory plan.

A second mandatory program would be justified only if two criteria were met. The first criterion would be that the current system was not working. The second criterion would be that there was no way to modify the existing mandatory program to correct problems with the current system.

Where I part company from proponents of a new mandatory retirement plan is that I believe the evidence shows that the current system is, in fact, WORKING FOR THE VAST MAJORITY OF AMERICAN WORKERS. And I believe the best way to improve the mandatory component of our retirement system is not to create a new plan, but to put Social Security on sound financial footing.

I see two primary reasons why people are willing to accept arguments that most workers are not prepared for retirement.

First, the role of Social Security—which provides the equivalent of a full pension to lower-earning workers, and substantial resources to higher-earning workers—IS SELDOM FULLY APPRECIATED. The adequacy of employer plans cannot be assessed in isolation—what matters is the resources that retired workers get from THE COMBINATION OF SOCIAL SECURITY AND EMPLOYER PLANS.

Social Security Represents a Pension for Lower Earners

Average projected Social Security replacement rate for workers in 1960s birth cohort if benefits are claimed at the full benefit retirement age (age 67)*

*For each worker, the replacement rate is the ratio of Social Security benefits net of income tax to average inflation-indexed lifetime earnings. Published replacement rates at age 65 are adjusted to reflect claiming at the 1960s birth cohort’s full benefit retirement age of 67.

Sources: Congressional Budget Office and Investment Company Institute

Second, the household survey data most commonly used to assess the system understate both THE SHARE OF WORKERS COVERED BY EMPLOYER PLANS and the AMOUNT OF INCOME RETIREES GET FROM EMPLOYER PLANS.

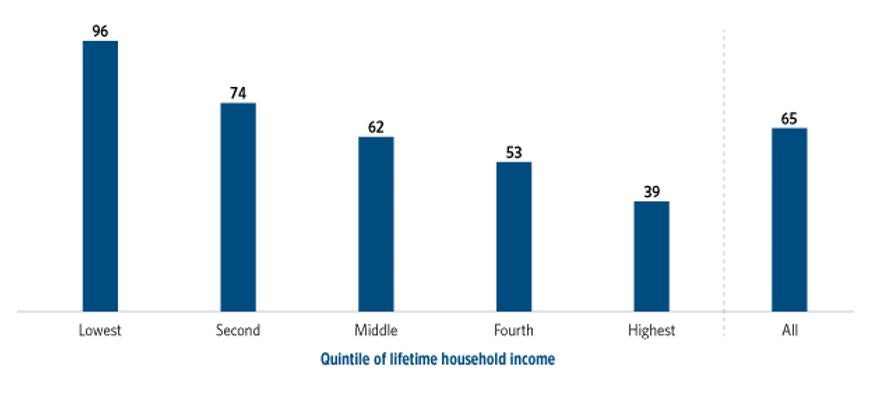

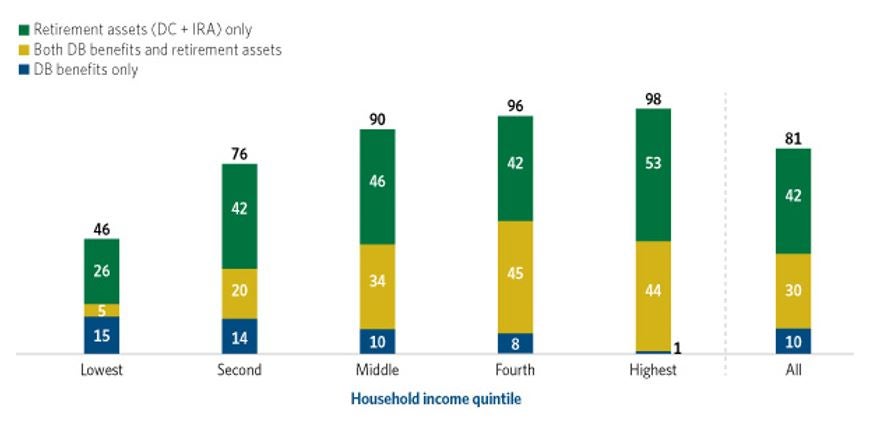

Here is just one piece of the evidence that the current system is working: most workers have resources from employer plans by the time they retire. Federal Reserve Board data show that 81 percent of working households aged 55 to 64 have accrued benefits in a DB plan, have accumulated assets in a DC plan or individual retirement account (IRA), or have both.

Most Near-Retiree Households Have Resources from the Voluntary Employer Plan System

Households age 55 to 64 with working head or spouse, by household income quintile, 2013

Source: Investment Company Institute tabulations of the Survey of Consumer Finances

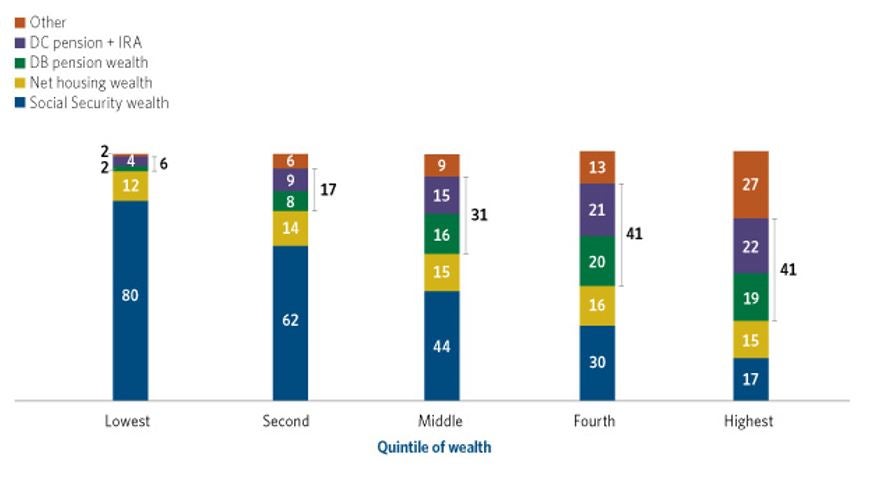

In addition, RESEARCH USING THE HEALTH AND RETIREMENT STUDY (HRS) and MY OWN RESEARCH USING TAX-RETURN DATA illustrate that not only are these resources widely held, they are substantial. For example, analysis of HRS data shows that in the middle wealth quintile of households with at least one member aged 57 to 62 in 2010, the combined value of future DB benefits and assets in DC plans and IRAs is about 70 percent of the value of future Social Security benefits. For the top 40 percent of households ranked by wealth in the same age cohort, the value of employer plan and IRA resources is greater than the value of future Social Security benefits.

Resources from the Employer Plan System Are Substantial

Percentage of wealth by wealth quintile for households with at least one member aged 57 to 62, 2010

Note: Households in the highest and lowest 1 percent of households ranked by wealth are excluded.

Source: ICI tabulation derived from an updated Table 3 of Gustman, Steinmeier, and Tabatabai (2009)

Although there will certainly be some Americans unprepared for retirement, the most careful analyses conclude that THE VAST MAJORITY (FROM TWO-THIRDS TO FIVE-SIXTHS, DEPENDING ON THE STUDY) ARE PREPARED. The notion of widespread retirement shortfalls obscures the fact that the US retirement system works well for the majority of households, and deflects attention from those groups actually at risk in retirement—such as those retiring early because of poor health and those with limited work histories.

To be clear, both the mandatory and voluntary components of the US retirement system face substantial challenges and could be improved. But the system is not fundamentally broken or in need of wholesale replacement. The most prudent path forward for policymakers is to build on the successes of the current system and focus on helping those who are most at risk.

The views and opinions of the author are their own and do not necessarily reflect the view of the Aspen Financial Security Program or our funders.