Our nation faces a significant and growing gap between the wealth of whites and that of people of color. This gap in wealth — in addition to the fact that large segments of the US lack savings or wealth to draw upon to weather financial shocks or to invest in the future — poses a growing challenge in a nation that is increasingly ethnically and racially diverse. Business ownership is a route to wealth creation, a particularly important and valued route in a capitalist economy. As such, it is important to understand the role that it plays in wealth creation for people of color and to identify and pursue strategies for addressing the challenges facing entrepreneurs of color. Below are four charts from a new white paper, “Bridging the Divide: How Business Ownership Can Help Close the Racial Wealth Gap,” that help explain these challenges.

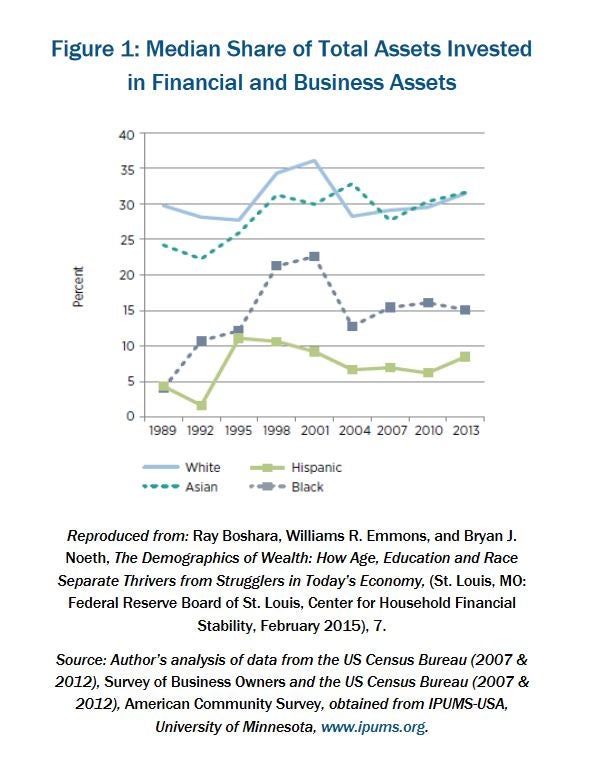

One of the reasons for the racial wealth gap faced by Latinos and African Americans is their relatively low levels of business and financial assets, which provide greater diversification and higher average returns over time than tangible assets such as homes and cars. As documented by the Center for Financial Household Stability at the Federal Reserve Board of St. Louis, Hispanic and black Americans have levels of net worth that are only one-tenth of those held by white Americans, and fewer of their assets are in the form of business assets. Specifically, while white and Asian Americans hold one third of their assets in business and financial assets, Hispanics and blacks hold only 15 percent and 8 percent, respectively, of their wealth in these forms.

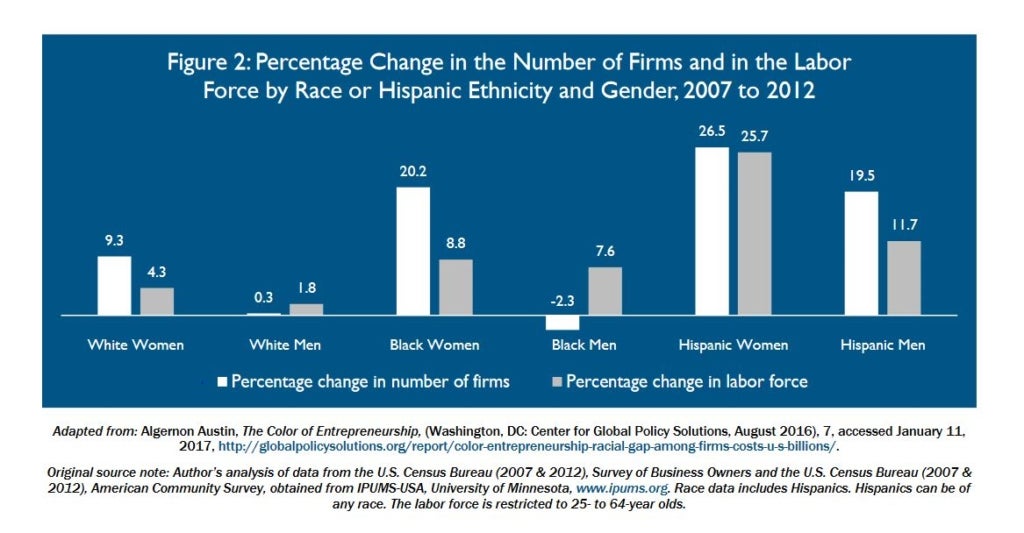

The lower levels of business wealth among people of color — and particularly among Latinos and African Americans — have historically resulted from two factors: lower rates of business ownership and the fact that businesses owned by Latinos and African Americans are also smaller, on average, than those owned by whites. In regards to the first factor, there is good news: there is an emerging class of minority entrepreneurs who have started firms.

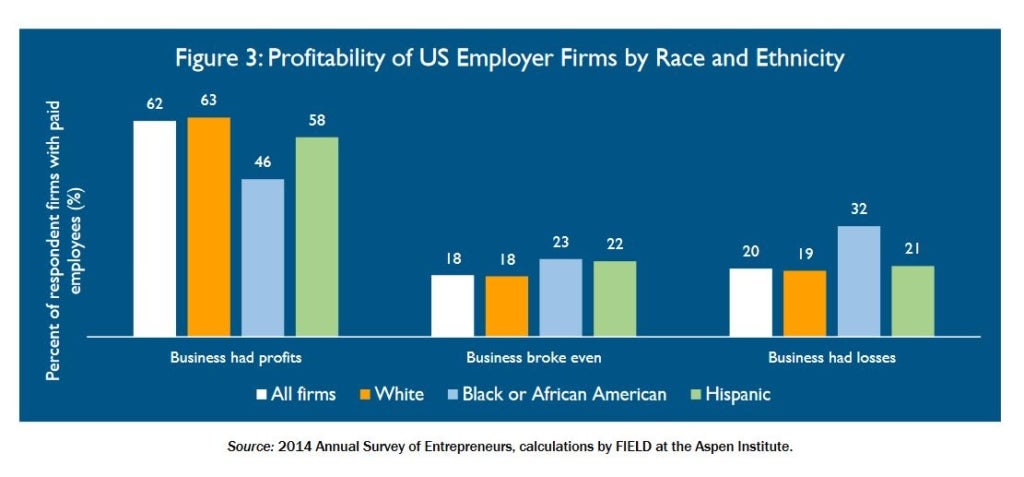

However, the second factor contributing to lower levels of business wealth, the smaller size of businesses owned by Latinos and African-Americans, remains a challenge. Recent data from the Annual Survey of Entrepreneurs, which covers firms with employees, found that African American- and Hispanic-owned firms were less likely to be profitable than those owned by whites. In 2014, 63.4 percent of white-owned employer firms indicated that they were profitable, compared to 57.7 percent of Hispanic-owned firms and 45.6 percent of African American-owned firms.

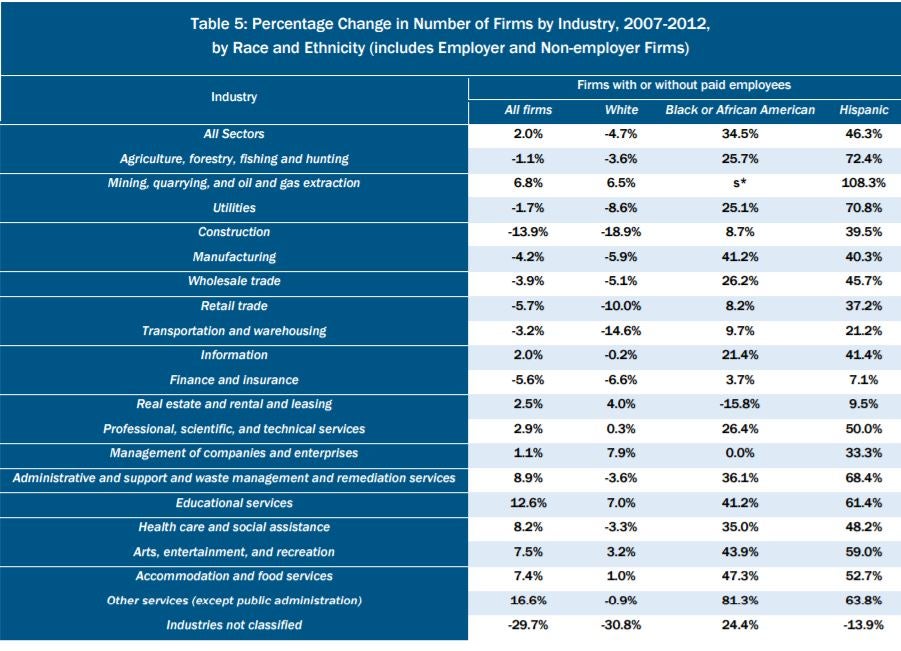

One of the reasons that African-American and Latino-owned firms are smaller is that the size of African-American and Latino-owned firms has been historically limited by industry sectors and the type of markets in which they operated. In the early 1970s, most minority business enterprises were service and retail establishments, many serving low-income and minority communities. That pattern remains in place, but industry concentrations mask significant growth in the construction and business services sectors relative to white-owned firms.

We can expand the role that business ownership plays in building wealth for people of color.

How can opportunities for business ownership be increased? There are both short-term and long-term strategies. In the short term, it will be crucial to expand access to credit for entrepreneurs of color. Having less wealth makes it harder to borrow money. Research confirms that African-American and Latino communities are less able to access bank financing, and therefore start their businesses with less capital, for which they pay higher prices. Meeting the capital needs of these entrepreneurs will require deliberate and culturally relevant outreach to communities of color. It will also be crucial to structure loans and related services to meet the needs of undercapitalized, low-wealth businesses.

In the longer term, policies that improve wealth and education levels of African-Americans and Latinos will help communities realize their entrepreneurial potential. This means addressing education in a meaningful way by creating stronger and more equal K-12 education systems and promoting policies that support college completion while minimizing student debt.

Entrepreneurial success will be one valuable outcome from addressing wealth and educational disparities faced by African-Americans and Latinos. Universal policies to narrow the racial wealth gap will help to realize the promise that business ownership holds for addressing inequalities. For more solutions, see the full report.