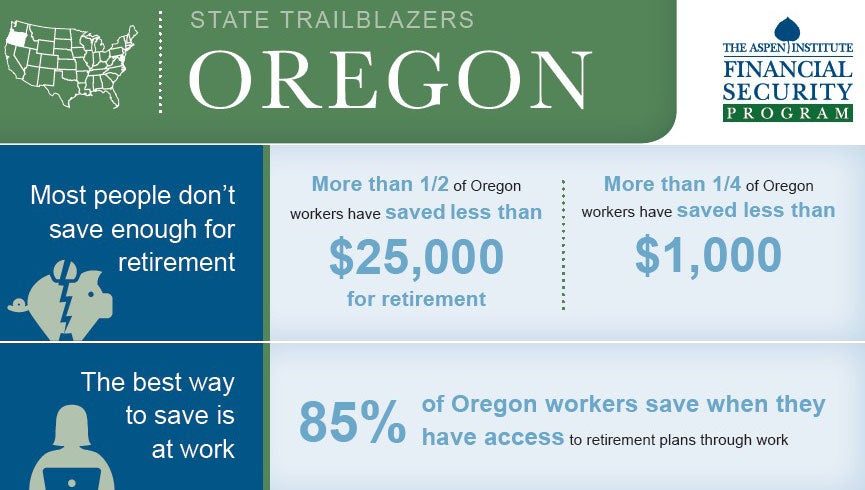

As millions of Americans live longer, and save less, the US workforce is veering toward a severe retirement crisis. IN OREGON ALONE, HALF OF THE WORKFORCE HAS LESS THAN $25,000 RESERVED FOR RETIREMENT. Saving through an employer-based plan is the most effective way to build a nest egg—but one million Oregonians lack access to a savings plan at work.

Oregon is one of the first states in the nation to tackle this problem directly with the Oregon Retirement Savings Program, a groundbreaking new system based on cutting-edge research. In 2017, it will offer automatic workplace enrollment and payroll deductions that should dramatically increase workers’ savings. Oregon’s plan is designed to minimize impact on employers and taxpayers while maximizing saving opportunities for workers. Other states are considering similar programs, so the lessons learned in Oregon could be magnified across the country.

With so much at stake for Oregon workers, and the nation as a whole, the Aspen Institute’s Financial Security Program brought together an array of business, research, and nonprofit leaders in a forum accessible to both the public and to the Board responsible for the Oregon Retirement Savings Plan. These experts offered ideas, insights, data, and other resources for the design and implementation of a successful rollout.

Watch a recording of the event here:

As millions of Americans live longer, and save less, the US workforce is veering toward a severe retirement crisis. In Oregon alone, half of the workforce has less than $25,000 reserved for retirement. Saving through an employer-based plan is the most effective way to build a nest egg—but one million Oregonians lack access to a savings plan at work.

Oregon is one of the first states in the nation to tackle this problem directly with the Oregon Retirement Savings Program, a groundbreaking new system based on cutting-edge research. In 2017, it will offer automatic workplace enrollment and payroll deductions that should dramatically increase workers’ savings. Oregon’s plan is designed to minimize impact on employers and taxpayers while maximizing saving opportunities for workers. Other states are considering similar programs, so the lessons learned in Oregon could be magnified across the country.

With so much at stake for Oregon workers, and the nation as a whole, the Aspen Institute’s Financial Security Program brought together an array of business, research, and nonprofit leaders in a forum accessible to both the public and to the Board responsible for the Oregon Retirement Savings Plan. These experts offered ideas, insights, data, and other resources for the design and implementation of a successful rollout.

Featuring:

The Honorable Kate Brown

Governor of the State of Oregon

The Honorable Ted Wheeler

Treasurer of the State of Oregon

The Honorable J. Mark Iwry

Senior Advisor to the U.S. Secretary of the Treasury

Will Sandbrook

Strategy Director, United Kingdom’s National Employment Savings Trust (NEST)

Anthony Bunnell

Chief Product Officer, Honest Dollar

John Chalmers

Abbott Keller Professor of Finance, Lundquist College of Business, University of Oregon

Kristian Foden-Vencil

Reporter and Producer, Oregon Public Broadcasting

Jessica Junke

Director of Economic Opportunity, Neighborhood Partnerships

Barbara March

CEO, BridgePoint Group

Judy Miller

Director of Retirement Policy, American Retirement Association

Lew Minsky

President and CEO, Defined Contribution Institutional Investment Association (DCIIA)

Nita Shah

Executive Director, Micro Enterprise Services of Oregon

Tom Simpson

Director of Government & Regulatory Affairs, Standard Insurance Company

The Oregon Retirement Savings Board was established in 2015 to develop and oversee the ORSP. The Board is chaired by State Treasurer Ted Wheeler, and its members are Kara Backus of Bullard Law; Kevin Jensen, former financial secretary of Ironworkers Local 29; Juanita Santana, a Head Start management consultant; and Cory Streisinger, former director of the Oregon Department of Consumer and Business Services. In addition, the Board includes Sen. Lee Beyer (D-Springfield) and Rep. Tobias Read (D-Beaverton) as non-voting members. For more information, please visit www.oregon.gov/treasury/ORSP/.

The Aspen Institute Financial Security Program is dedicated to solving the most critical financial challenges facing America’s households, and to shaping policies and financial products that enable all Americans to save, invest, and own.