A Stake in the Upside: Understanding the Ownership Economy

This year’s Aspen Ideas: Economy gathered 500-plus leaders and innovators in Newark, New Jersey, for a two-day event that anchored the story of our global economy in real people, real places, and real dialogue, creating a deeper understanding of the forces of change in our economy and our lives. As the program came together, a few throughlines emerged, leading us to organize sessions that highlighted three themes: the Creative Economy, the Ownership Economy, and the Longevity Economy.

“Ownership is not just about assets. It is also about agency, resiliency, security, belonging, and really having a say in shaping the future that we are collectively building together.” So said Paula D’Ambrosa, Director of Inclusive Wealth-Building at Prudential Financial, at Aspen Ideas: Economy a few weeks ago.

If the phrase “ownership economy” sounds a little redundant, it may be because “who owns what” is the central disagreement of economic ideologies—and a few bloody revolutions. But as it’s used today, the “ownership economy” is about the ability for individuals to own and control assets that generate wealth. Ownership—in their home, in a piece of the place where they work, in capital market investments, or even in a neighborhood building—allows Americans to share the real benefits of a growing national economy, and offers a hedge even when things slow down. To make widespread financial security a reality in the United States, we need to empower individuals and communities to create and keep their own wealth—and that starts with owning things.

Why ownership matters

D’Ambrosa helped frame the discussion in an introduction to the session Wealth, Ownership, and Lifelong Prosperity. She made a four-part argument for the importance of ownership, paraphrased here.

- Ownership gives people control of the decisions that are affecting their everyday lives—and it gives them grounding in a world that many feel is careening out of control.

- Ownership can build wealth. This is particularly important in a reality in which wage growth is lagging behind productivity growth, and where real income gains come from owning appreciating assets. Compounding is magic, if you’ve got something to compound.

- Broad ownership builds belonging. Retention and satisfaction are higher in employee-owned companies, and in community investment models, residents are more civically and economically engaged.

- Ownership is good for the economy as a whole. When ownership is shared broadly, it makes entire economies more resilient, giving people financial stability and keeping wealth local.

Who owns what now?

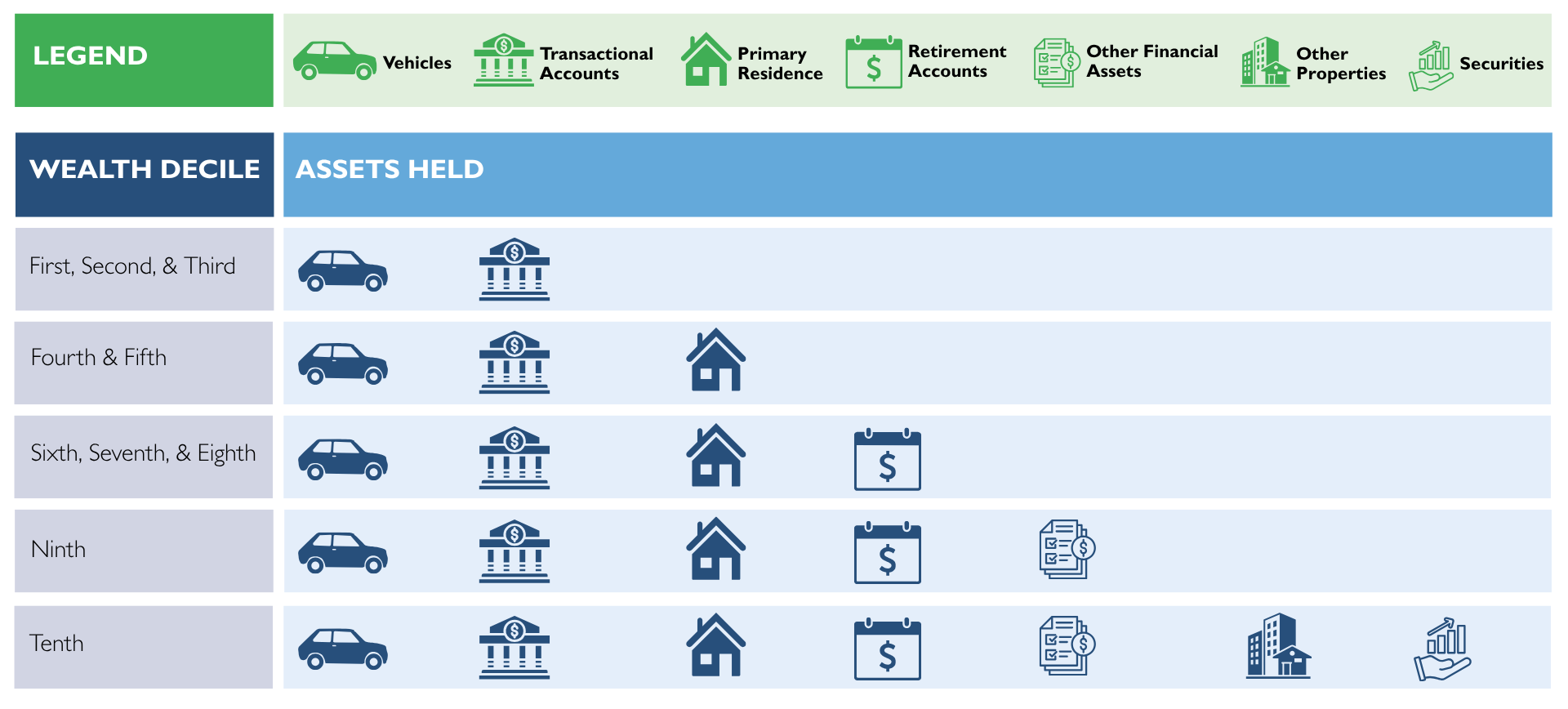

Things are dark on the ownership front, however. Analysis by the Aspen Institute Financial Security Program (FSP) shows that the bottom 50% of US households by median wealth—that’s 66 million families—own only about 2.5% of total US household wealth. The top 10% of households—about 13 million families—own more than 75%.What they own matters, too. Real estate, retirement accounts, and securities and investments appreciate, and they’re owned mostly by wealthier households. Necessities like cars and checking account balances don’t grow over time. That means that the top 10% of households has a median net worth of about $2.5 million, and the bottom 10% has a net worth of negative $9,800.

This isn’t a problem anyone is likely to get free of through hard work, either. Productivity gains are becoming increasingly lopsided, accruing more to owners of capital than to workers. “If that is true, there is no way to close those gaps,” said impact investing strategist Antony Bugg-Levine, later in the session. In the old balance-sheet way of thinking—in which a family pays off its debts, saves up some money, and then begins to invest—the investing simply comes too late to be meaningful, if it comes at all.

All of this paints the current ownership economy as less of an actuality, and more of an aspiration—something we should be moving toward. Fortunately, we’ve got a lot of great people leading us in that direction.

Ownership On-ramps: Making the Ownership Economy Accessible

“The clearest pathway to wealth is through ownership; that is unequivocal. But what happens when the majority among us do not see a path to participation?” That’s Trevor Rozier-Byrd, founder and CEO of Stackwell Capital, speaking last month at an Aspen Ideas: Economy session, Investing in Widespread Wealth and Ownership.

The ownership economy—and the agency, belonging, and stability it brings—was the subject of the previous issue of The Slice, where we noted that the bottom 50% of US households by median wealth own only about 2.5% of total household wealth. If we, as a nation, want an economy that works for everyone, we need to make ownership something anyone can achieve.

The Everything Approach

At the event in Newark, Rozier-Byrd—a fintech innovator helping new investors—shared the stage with Philip Reeves and Nicolas Salerno, innovators in employee ownership and homeownership, respectively. The three of them, and other leaders in other sessions, spoke not only about the whys of ownership, but the hows—approaches that have come to be known as “ownership on-ramps.” These leaders bring great ideas and great experience to the challenge, and we as a society are going to need it all.

“There is no one strategy that can single-handedly reduce wealth disparities at the scale required to meaningfully improve financial well-being for the nation’s millions of economically vulnerable households,” says Ownership Investing: Financing the Future of Wealth, a 2024 report from the Aspen Institute Financial Security Program, Gary Community Ventures, and The Bridgespan Group. That report focuses on four main approaches; we’ve followed their format here, adding new research and commentary.

Individual Financial Assets: Perhaps the most obvious approach, it’s also time-tested—think stock portfolios and retirement accounts. But those avenues are too infrequently utilized by low- and middle-income families. The National Strategy for Financial Inclusion is a big step forward, and the new Trump Accounts will make early investors of every American child, assuming auto-enrollment. (A December 4 webinar, How Can Trump Accounts Build Wealth for Low- and Moderate-Income Households?, will explore the subject in depth.)

Inclusively Owned Commercial Real Estate: This experimental but promising on-ramp is based on shared ownership of commercial properties, offering a win-win-win scenario for real estate developers, local residents, and large investors. Here’s a primer on how that works, and a Q&A from leaders of LocalCode Kansas City.

Employee Ownership: This route is effective, proven, and popular, but stymied by policies, practices and norms. Aspen Institute’s Economic Opportunities Program is a regular convener, collaborator, and catalyzer on the subject of employee ownership and profit sharing. To get a handle on the scope of the opportunity, start with Race and Gender Wealth Equity and the Role of Employee Share Ownership, and then learn how to make it happen in this wide-ranging collection of resources from the Job Quality Center of Excellence. The Slice has been known to interview the program’s fellows and grantees about employee ownership, as in these two profiles.

To dive even more deeply, set aside June 2-3, 2026, to attend the next Employee Ownership Ideas Forum, hosted in partnership with the Rutgers Institute for the Study of Employee Ownership and Profit Sharing. At last year’s event, Kevin Clegg, CEO of the employee-owned Clegg Auto, spoke of some of the non-financial benefits of the arrangement. “I have a company that’s full of people who care. And when you ignite the care factor, suddenly work’s not work. Suddenly, it’s something to look forward to, and when you come home from work, you have energy to give to your community and to your family. And that changes massive amounts of lives.” Sign up here for updates on the Forum.

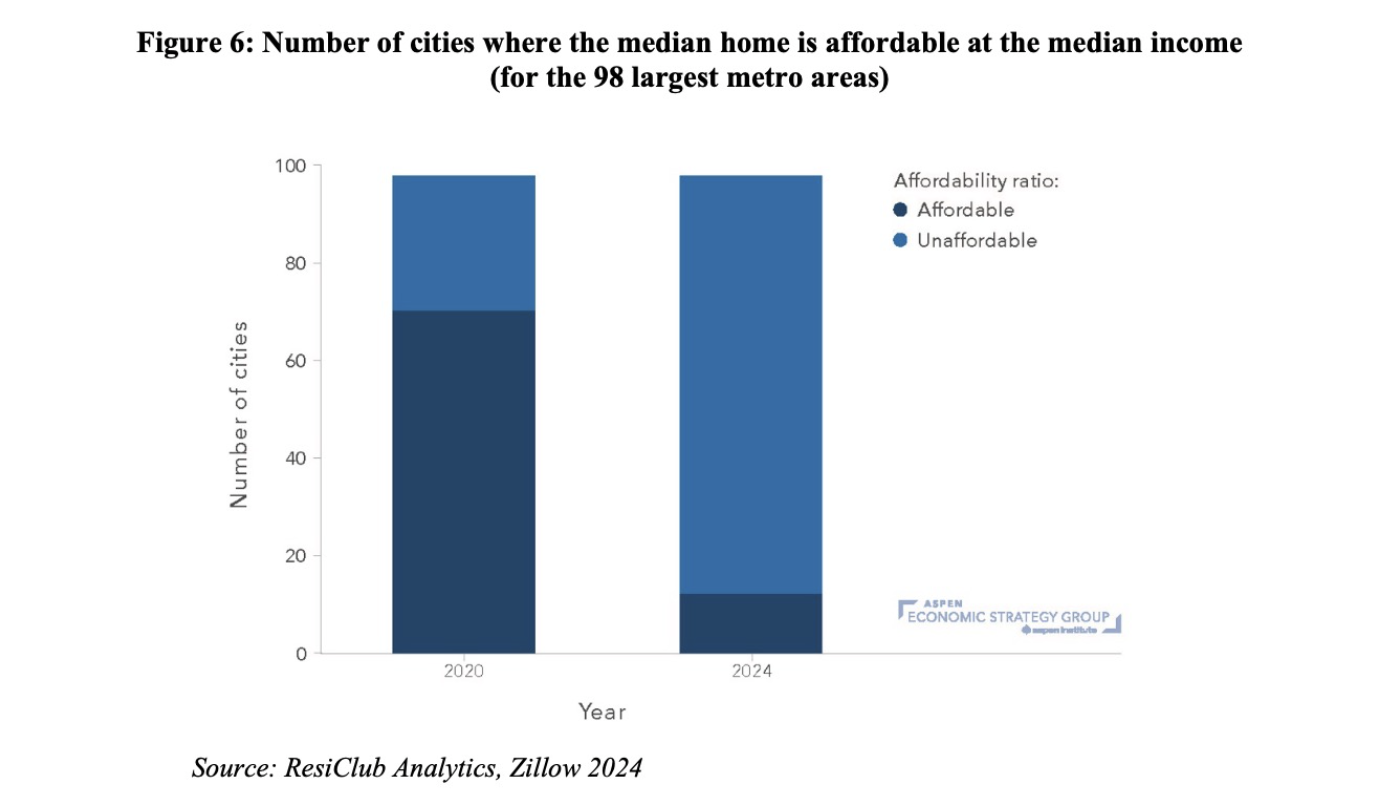

Homeownership: This is the elephant in the (too-often-rented) room. Home equity is the largest source of wealth for most people in the US, but it’s become increasingly out of reach. Read more about the situation—and why renters are looking to other ownership avenues—in From Rent to Riches? A Profile on the Wealth and Financial Well-Being of Renter Households from Aspen FSP.

The complementary—and necessary—approach is to bring homeownership into reach of more people. The recent report Improving Housing Affordability from Benjamin J. Keys and Vincent Reina for the Aspen Economic Strategy Group names the big barriers, and then suggests three key policy proposals that would make this key asset class available to more Americans. Read the full report here.