The vast majority of households across the country will inevitably face a financial shock each year. These financial shocks may result from benefit loss or reduction, impacts to income or expenses, property damage or savings loss, or other life events. Yet, despite the frequency of these shocks—and the recent innovation and increase in the availability of financial tools and services—households continue to struggle to either find what they need or navigate the patchwork of potential options to address shocks and maintain their financial stability. Without the proper safeguards to keep them afloat, people may find themselves stuck in a vicious cycle that leaves them less and less equipped to handle the next financial shock.

The Aspen Institute Financial Security Program (Aspen FSP) believes that we can better address this omnipresent challenge by centering peoples’ lived experiences in our assessment of whether the programs, policies, and products in the public and private marketplace are addressing the scale of the problem and what is needed to develop, deploy, or advance practical solutions. One way Aspen FSP has adopted this person-centered approach is through our Community Advisory Group (CAG). Composed of nine leaders with direct and professional expertise in financial insecurity, the group provides deep, ongoing feedback into our work.

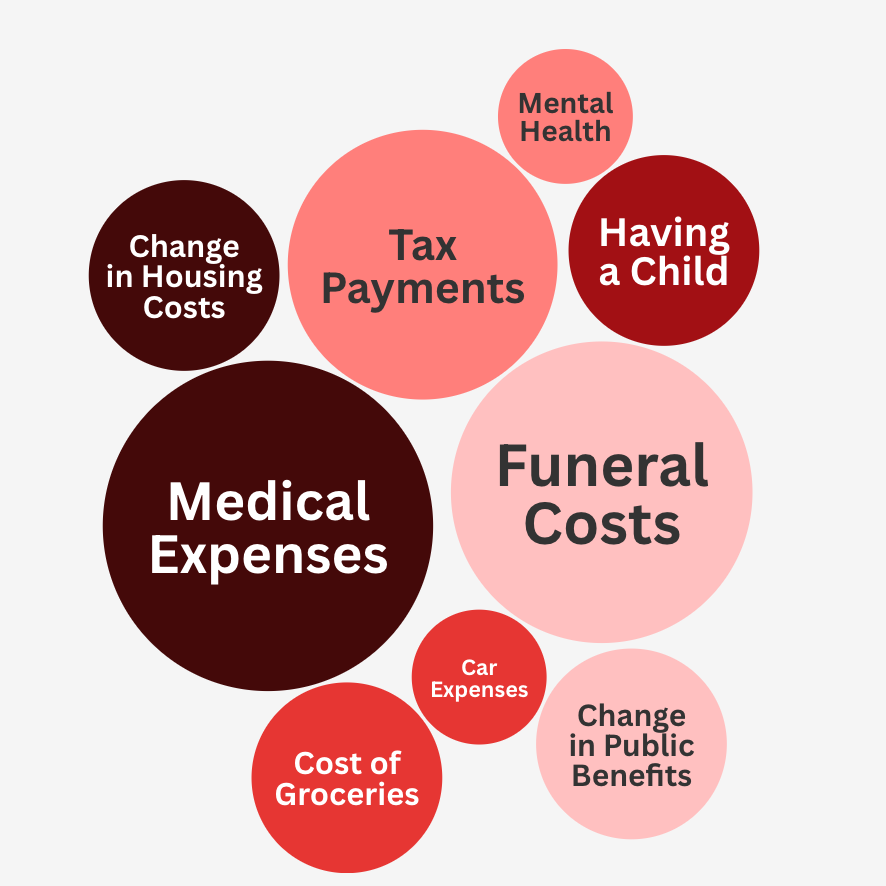

During our 2025 CAG in-person convening, Aspen FSP hosted a workshop aimed at identifying the financial shocks that are most pertinent to their lives. To accomplish this, CAG members were presented with a range of financial shocks and asked to vote for the shocks they found most stressful and most challenging to resolve in their own lives. The bubble charts below demonstrate the results of this activity:

Hardest to Resolve

Most Stressful

Bubble charts designed by Grace Castelin with Flourish.

The financial shocks that rose to the top—during the voting activity and our discussion—were funeral costs and health-related shocks such as medical expenses, managing one’s mental health, and having a child. CAG members noted that these shocks can cause both emotional and physical distress, making them particularly difficult to navigate. They stated that even when they paid into resources intended to help manage financial shocks, such as health insurance and life insurance, those resources rarely cover these expenses in full. One CAG member said, “The safeguards you thought you had in place often aren’t there.” Moreover, accessing these various forms of insurance can be a cumbersome, time-consuming process, and finding the right information is not always straightforward.

To cope with these financial shocks, CAG members said they have turned to a combination of resources like credit cards, payment plans, mutual aid, and grants, noting that these often have to be pieced together in order to be sufficient. One CAG member recounted her experience maxing out credit cards to cover funeral expenses for family members: “I sacrificed for years to build up a good credit score just to watch it wiped out in an instant. I maxed out multiple credit cards to pay for the funeral of a family member, as devastating as this is, I am still blessed that I had good credit to even be able to do that. It has pushed me back to ground zero, but it’s what I had to do at the moment.”

This workshop with CAG members also demonstrated the human toll of financial shocks and the disconnect between the landscape of financial products and services and the people they should reach. As people face the sticker shock that often accompanies a medical bill or funeral expense, they also experience the cognitive overload of navigating an evolving product landscape. For example, in the absence of adequate insurance or emergency savings, should someone try to negotiate a payment plan with the hospital, open a new line of credit, or borrow from retirement savings? One CAG member stated “[there are] chains of shocks, the important thing to understand is which one affects [the] others, the connection between them.” Determining the best course of action for a particular individual or household based on their circumstances is challenging enough on a good day; adding time constraints, insufficient information, and emotional, physical, or mental health-related impacts can compound to wipe out built-up financial health.

“Without the proper safeguards to keep them afloat, people may find themselves stuck in a vicious cycle that leaves them less and less equipped to handle the next financial shock.”

To meaningfully help people overcome an unexpected expense or series of expenses, financial solutions must be responsive to people’s lived realities and needs. Financial institutions and other key stakeholders can accomplish this by implementing human-centered design principles in the development of their own products, conducting research that centers the experience of real people, or building advisory groups for ongoing feedback on operations.

Aspen FSP is committed to building upon these initial findings and will be continuing its work on financial shocks throughout the next year. We will:

- Produce an updated understanding of financial shocks, identifying the typology, frequency, and severity of shocks that influence how people are able to cope with and prepare for a shock;

- Identify opportunities to expand or scale existing products that are working well, modify existing products that could be working better, and consider market gaps that new tools could fill; and

- Investigate the role of institutions, markets, and policy, identifying how our financial system delivers on financial resilience for U.S. households and how we can improve on these systems.

Aspen FSP aims to translate these person-centered insights into actionable, systemic solutions that help people recover from a financial shock and equip them to thrive in the long-term.